Cryptocurrency whales have significantly increased their holdings in $PEPE, $LINK, $UNI, $MKR, and $ENS, with notable transactions on Binance. One notable transaction involved an anonymous investor moving 322.48 billion units of PEPE, worth approximately $2.78 million.

This indicates a strong, bullish stance on PEPE, signaling potential future appreciation. The timing and scale of this transaction may hint at insider confidence in the asset’s performance. Another significant actor, using the pseudonym “aavebank.eth,” took out large sums of money from Binance in just six hours, resulting in a mixed portfolio withdrawal.

Market whales bet on crypto value appreciation, as the withdrawal of a substantial volume of cryptocurrency may create a material liquidity shortage and destabilize prices. These investors can increase the price if demand remains constant or grows by reducing the availability of supply on exchanges.

The withdrawal of several assets from the exchanges indicates that these whales expect positive outcomes from their holdings and are trying to take a long-term approach rather than short-term profits.

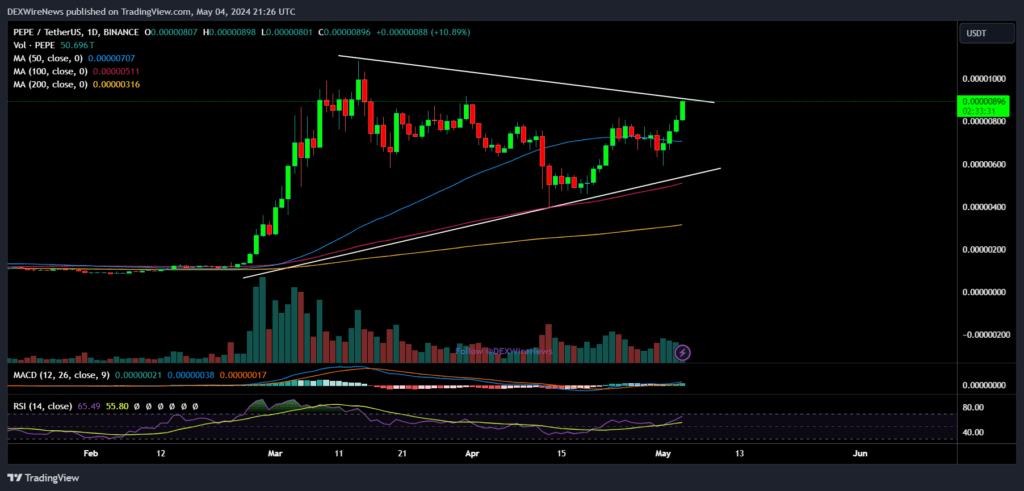

PEPE trading activity spikes, with the Moving Average Convergence Divergence (MACD) indicator indicating a bullish crossover. The recent crossing of the MACD line below offers another confirmation of this trend, which is in line with the visible market price spike for PEPE.

PEPE’s Relative Strength Index (RSI) indicator is at 64.86, showing strong buying pressure and below the overbought threshold of 70, suggesting there is still room for price growth before the market could become overheated.