For Indian users, there were not many platforms to buy and sell bitcoin or other cryptos directly in Indian rupees until 2018.

But now there are many (not much), including CoinSwitch, that allow to buy, sell, and exchange almost any cryptocurrency with a bank account deposit and credit card.

Not just for Indian users, CoinSwitch is available almost in all countries to buy, sell, and exchange any currency.

So in this CoinSwitch review, we will find out in which countries CoinSwitch supports, features, and many more.

So with no delay, let’s start the CoinSwitch review.

What is CoinSwitch?

As we said, CoinSwitch, also known as “CoinSwitch Kuber,” is a platform that allows its users to buy, sell, and exchange vast numbers of cryptos in their local currencies with bank account deposits and credit cards.

CoinSwitch Background.

CoinSwitch is a Bangalore, India-based startup founded in 2017 by Ashish Singhal, Govind Soni, and Vimal Sagar Tiwari. Since then, it has been growing rapidly among users, especially Indian users.

CoinSwitch wallet alone accumulates around 12% of users in India and may have a chance to increase this number.

CoinSwitch supports countries.

Like other crypto trading platforms, CoinSwitch has also restricted some countries. The following countries are restricted:?

North Korea, Sudan, Syria, Pakistan, Afghanistan, Cuba, Iran, Crimea, and the United States of America (including all USA territories like Puerto Rico, American Samoa, Guam, the Northern Mariana Islands, and the US Virgin Islands St. Croix, St. John, and St. Thomas).

If you are from one of these listed countries, then you cannot use CoinSwitch; maybe you could access it by using a VPN. But if CoinSwitch finds out, then your account could be permanently banned.

Coins are supported by CoinSwitch.

Currently, CoinSwitch has about 654 coins listed for buying, selling, and exchanging. If you look for popular coins, then it has Bitcoin, Ethereum, Bitcoin Cash, Ripple, Monero, Chainlink, Litecoin, Defi coins, stablecoins, and many more. See all the listed coins.

Supporting payment methods on CoinSwitch.

You can buy coins with a credit card, bank account, UPI, or cryptocurrency deposit. For the credit card, about 100+ coins are available for buying and selling. While buying and selling with bank deposit features is only available for Indian users,.

Where other crypto trading platforms only allow high liquidity for buying and selling, like BTC, ETH, BCH, and USDT, on CoinSwitch you can buy or sell any listed coins, so you don’t need to exchange your coin before selling.

CoinSwitch fees.

The fee is the most important part of trading in the CoinSwitch case; it doesn’t show fees on the platform and only shows the amount you will receive, including exchange, mining, and other fees.

But if you go deeper into the fee, you will find around 0%–0.49% (this includes only the CoinSwitch fee).

For more clarity, we go to CoinMarketCap to calculate the current market price, and we find it.

If you buy $1000 worth of BTC with a credit card payment method at the $10,428 (0.09588873 BTC) market price, then you will receive 0.08713616 of BTC, which is $908.89 according to the current market.

In simple words, if you buy $1000 BTC, then you will receive $908.89 worth of BTC with the credit card payment method.

In the case of a bank account deposit (only for Indian users), the fee is almost nothing compared to others. And if you buy ₹1000 worth of BTC at ₹767,165 market price, then you will receive 0.00124501 BTC, which is worth ₹955 BTC, and it is extremely low for Indian users.

Supporting fiat currency.

To buy and sell around it, CoinSwitch supports the following fiat currencies:.

DOP, EUR, GBP, GE, HKD, HUF, IDR, ILS, INR, JPY, KRW, KZT, MAD, MDL, MXN, MYR, NAD, NGN, NOK, NZD, PEN, PHP, PLN, QAR, RON, RUB, SAR, SEK, SGD, TRY, TWD, UAH, USD, UYU, UZS, VND, ZAR.

CoinSwitch limit.

Like others, it also has a limit that applies to all users. For users of credit cards, it starts at $50 and ends at $50000.

Users with the first transaction can buy $50–$1000 of BTC, and after that, it will increase to up to $20000 daily limit and up to $50000 monthly limit, which is a very low amount for large traders.

For Indian users, the limit starts at ₹100 and ends at ₹2,50000 if they buy with a bank account deposit.

Exchange to another.

Yes, it has exchange features, so you can easily exchange your coins for other highly profitable coins.

CoinSwitch supports over 654 cryptocurrencies with 45,000+ trading pairs.

KYC verification on CoinSwitch.

CoinSwitch does not require KYC to buy cryptocurrencies with fiat, but if users do, their KYC can access a wider range of features and they can also sell their coins for fiat. Users can also exchange their coins for others without KYC.

CoinSwitch support.

Supporting them is the same as others, but more quickly than others. You can contact them via email, chat, or other social media. But before you make sure of your problem in the FAQ or not,.

For more clarity, I contacted them via live chat, and they replied in just 2 minutes. Eliot from 99Bitcoins contacted me via email, and they replied within an hour.

CoinSwitch online reviews.

I went to Trustpilot and PlayStore to find the CoinSwitch user experience. It has been given 4.5 and 4.6 stars from 556 and 4000 users of Trustpilot and PlayStore, respectively. And it has a positive review, especially for solving problems.

I won’t suggest you use CoinSwitch after seeing its online reviews because you know that reviews are almost fake and misleading.

Device support.

You can use CoinSwitch in the PC and Android apps to buy, sell, and exchange cryptos. And for Apple users, it is not available currently.

How do I buy crypto with a credit card on CoinSwitch?

Buying crypto on CoinSwitch is easy, like sending a message on What’s Up, and you just have to.

- Go on the CoinSwitch website and find a buying option.

- Click on it, and you will see a simple page.

- Choose fiat currency and the coin you want to buy, and then enter your coin wallet.

- And click continue; a page will open on Simplex here. Fill in your credit card and your information, and send the payment.

- After a few minutes, your coins will arrive at a given wallet address.

How do I buy crypto with bank deposits on CoinSwitch? (In India)

To buy and sell crypto in India with a bank account deposit, you first need to download the wallet app and create an account.

Due to regulations, you will need to complete KYC, and after that, you can buy and sell any coins. To do this.

1. Open your CoinSwitch wallet app and click the recharge wallet.

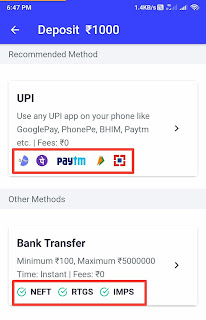

2. Enter the amount and click deposit. Here, you can choose any option, like bank transfer, Google Pay, UPI, PhonePay, or PayTM.

3. Choose any option and then send money. After a few minutes, your money (not coins) will arrive in your wallet.

4. Again, open the CoinSwitch wallet, select the coin you want to buy, and then exchange rupees for any selected coin.

How do I withdraw crypto from a bank account? (In India).

The process is the same as above, but with a little difference. Before you withdraw, make sure you have a connected bank account in your wallet. For doing this.

- First, sell your coin for the INR that you have.

- Click on the Indian rupee logo and then withdraw.

- Enter the amount and OTP that have been sent to your linked email address

- And that’s it; your money will arrive within 15 minutes in your connected bank account.

Conclusion.

Well, CoinSwitch looks like an alternate trading option, not permanent. It could be best for newbie users who want to buy cryptocurrencies with a credit card.

For Indian users, I will definitely suggest you try Coinswitch because it has the lowest fee and also has many payment options.

If I am talking about trust, then yes, CoinSwitch is safe and legit.

Well, just trading or buying cryptos is not sufficient. You must have an excellent and secure wallet to store your precious coins in. So here are some wallets that I prescribed to you.

1. Exodus wallet.

Manage your wealth in a blockchain wallet that combines solid engineering and beautiful design in the form of live charts that update in real-time.

Exodus allows you to secure, manage, and exchange your favorite cryptocurrencies like Bitcoin, Ethereum, Ripple, and more from an easy-to-use wallet that puts you in control of your wealth.

2. Enjin wallet.

Meet your other anonymous crypto wallet to manage a thousand coins, tokens, and more in one place.

This anonymous wallet is totally built for everyone for trading, holding, gaming, and more.

3. Lumi wallet.

Fully featured and highly secure anonymous wallet for beginners as well as pro users. It supports around 1200+ coins and tokens for buying and exchanging with a few clicks.

If you are from a European country, you can easily withdraw your bitcoin with your Visa bank card.

If you are buying your first bitcoin, then you should know something about it before jumping into it. And also know how to secure your wallet to avoid money loss.

By the way, what do you think about CoinSwitch? If you think I have missed something in this CoinSwitch review, then notify me.