Before you learn how to start cryptocurrency trading, it’s important to understand what this process actually involves.

Over the past decade, cryptocurrency trading has exploded in popularity. The rise of Bitcoin, Ethereum, and other altcoins has captured headlines worldwide, turning crypto into one of the most talked-about financial topics today. As a result, more and more people are considering entering the market to try their hand at trading.

Cryptocurrency trading is the practice of buying and selling digital assets with the goal of making a profit. It’s an exciting and fast-moving market that gives traders access to global opportunities 24/7. But while the potential rewards are high, cryptocurrency trading also comes with unique risks and challenges. That’s why beginners need to understand the basics before diving in.

Keeping the basis in mind we’re going to look out all questions to start your first cryptocurrency trading.

How to Start Cryptocurrency Trading?

Select Best Cryptocurrency Exchange

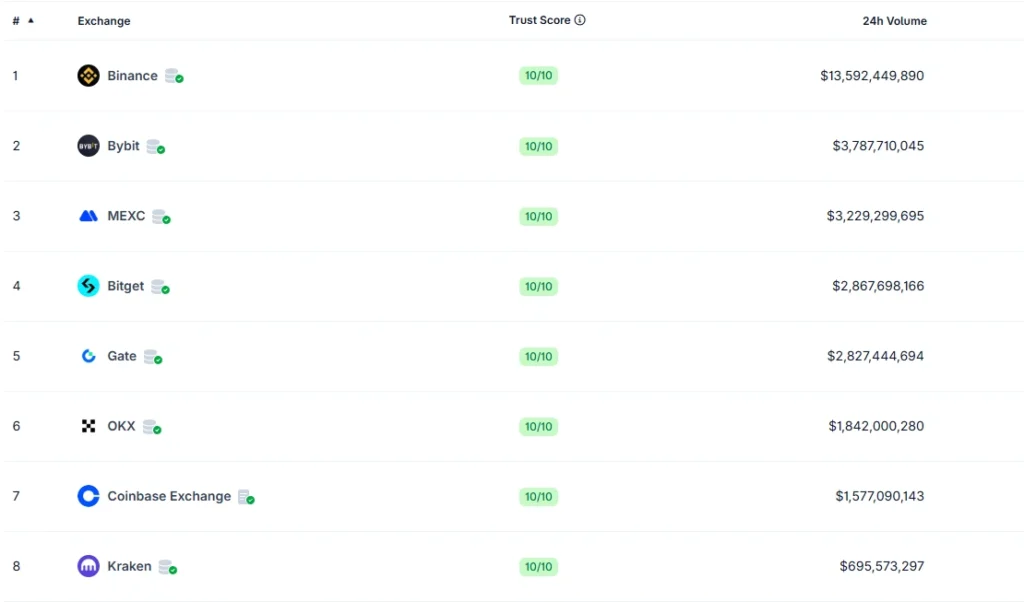

If you’re ready to begin cryptocurrency trading, one of the most important decisions you’ll make is choosing the right exchange. The platform you select will directly impact your trading experience, costs, and security.

Since every exchange has different strengths and weaknesses, the best choice depends on your goals and strategy.

For example, Coinbase is often recommended for beginners because of its simple interface, while platforms like Kraken or Binance offer more advanced features and trading options. Your decision should be based on factors such as ease of use, security, fees, available cryptocurrencies, and regulatory compliance.

Remember: if you don’t pick a reliable cryptocurrency exchange, you risk losing money through high fees, poor security, or lack of regulatory oversight.

When deciding on the best exchange for cryptocurrency trading, keep these points in mind:

- It must be easy to use and navigate.

- Choose a site with high-security standards.

- Look at reviews of the crypto trading site.

- Should have fiat deposit and vast payment methods.

- The crypto exchange should offer many popular cryptocurrencies or tokens (including BTC) so that you can buy whichever coin you want.

- Find out what kinds of fees they charge (e.g., fees for withdrawing or exchanging currency).

- Make sure they are regulated by an international regulatory body so that they are compliant with global laws and regulations.

What are the Best Crypto Exchanges for Beginners?

The first step to starting cryptocurrency trading is choosing an exchange platform that fits your needs. For beginners, the right exchange should be simple to use, secure, and provide access to the most popular cryptocurrencies.

Different exchanges offer different features, so it’s important to compare before making a choice. Some platforms allow fiat currency deposits (like USD, EUR, or INR), making it easy to buy your first crypto directly with a bank transfer or bank transfer. Others focus only on crypto-to-crypto trading, which may be better for more advanced users who already hold digital assets.

Binance. This can be a great place for beginners to start trading cryptocurrency because it has a wide range of coins and pairs (buy and sell) that you can trade.

Coinbase Pro. If you only want to stick with popular cryptos and don’t want to trust low-market-value cryptos, then Coinbase Pro could be the best for you to start trading in bitcoin because it has many pairs against BTC.

Kraken. It lets you trade your crypto at a low fee and with a high limit on the pro trading interface chart. Like Coinbase Pro, it also has a lack of crypto pairs but a high number of fiat pairs such as USD, EUR, AUD, and GBP.

HTX. If you like bonuses, then say no more. Huobi regularly announces new ways to trade different altcoins, so you have a chance to win extra cryptos without losing your money.

Setup All Security Features Before Crypto Trading

Enable all available security features before starting cryptocurrency trading.

Since your computer serves as your trading platform, keeping it secure is essential. Install trusted antivirus software, activate firewall protection, create strong passwords with letters, numbers, and symbols, and enable two-step verification for your email account.

Cryptocurrency exchanges are responsible for safeguarding your funds and providing strong protection in cryptocurrency trading.

However, history shows that even exchanges can be hacked and lose client funds. Always research an exchange carefully before choosing one, follow its security guidelines closely, and enable 2FA wherever possible.

Fund Your Crypto Trading Account

If you’re using an exchange that supports direct crypto purchases, you’re making a smart choice. This option helps you save on transaction fees, since you can simply buy popular coins like BTC, ETH, or USDT and then use them to start cryptocurrency trading against a wide range of other tokens.

If the buy feature is not in your crypto trading exchange, then you need to follow some extra steps.

- First create an account on an exchange platform (Ex -Binance, Gate, Coinbase) that allows you to buy cryptocurrency.

- Complete KYC (if necessary) and buy USDT, BTC, or ETH (if possible).

- Go to your trading exchange you selected (ex-Kraken), find your wallet address, and choose a coin.

- Go back to the exchange platform, find the coin you want to transfer, and enter your wallet address.

- After a certain confirmation, your coin will arrive in your trading exchange account.

How Much Does It Cost to Buy Cryptocurrency?

So, how much does it actually cost to buy cryptocurrency? The answer is that there’s no fixed price. Cryptocurrencies can be purchased in small or large amounts, depending on the exchange and the currency you use for the purchase.

The good news is that many exchanges allow beginners to start cryptocurrency trading with as little as $10 to $20. This makes it easy to practice trading strategies and gain experience without needing a large investment.

Because the cryptocurrency trading market is highly volatile, beginners should avoid investing money they cannot afford to lose. A good rule is to start with only the amount you’re comfortable losing without affecting your day-to-day lifestyle. This way, you can gain experience while keeping your financial risks under control.

Here is the minimum amount of money you need to start trading cryptocurrency on these exchanges.

| Exchange | Minimum Amount |

|---|---|

| Binance | 1 – 15 $ |

| Bybit | 2 – 10 $ |

| Kraken | 10 $ |

| BitBNS | 100 ₹ |

| Huobi | 10 $ |

Now Choose a Cryptocurrency (Coin) for Trading?

Cryptocurrency trading is risky. There are a lot of factors that can make trading less than ideal. If you trade cryptocurrencies, here are some things you should know about how to choose a cryptocurrency and the risk involved in investing in cryptocurrencies.

In order to decide which cryptocurrency is best for trading, it helps to first define your goals. For example: Are you looking for a currency with low volatility? Do you want an anonymous coin with more privacy features? Is there an ICO (Initial Coin Offering) or hard fork coming up that could increase demand for a certain coin?

Keep in mind that when you start trading crypto, there will always be risks. The market changes quickly, so it’s important not to get too emotional and use logic instead when making trades.

Remember: You don’t need to predict what the price will do—instead focus on what direction you think it will go before placing your buy or sell order!

Choosing a cryptocurrency for trading can be tough. There are so many different types of crypto coins, and each one offers different benefits and drawbacks. It is important to do your research before investing in any new coin.

Choose Types of Cryptocurrency Trading

Spot trading

Spot trading involves buying one currency and holding it for a certain amount of time, hoping that the value will increase.

Margin trading

When you use margin trading, you are borrowing money from a broker to trade with more funds than you have in your account. Margin traders can boost their holdings significantly, but if a market moves against them, they can quickly lose all of their funds.

Futures trading

Future trading refers to a method of speculating on the price of assets, including cryptocurrencies, without actually owning them.

Best Time for Cryptocurrency Trading?

This can depend on the type of cryptocurrency you are trading. Some traders prefer to buy at a low point and sell when the price is high, while others look for long-term investments.

To find out when the best time might be, you should do some research on different types of cryptocurrencies and how they fluctuate in price over time. If you are looking for a short-term trade, it is important that you buy when the market dips and sell before it goes back up.

If you want to invest in a cryptocurrency, it may be better to hold off until it is at its lowest point before buying in order to get the best deal.

However, if you are planning to make a quick buck, this isn’t always an option as the price will continue to change as more people buy in. The key here is not just choosing one particular cryptocurrency but diversifying your portfolio so that your investments are safe and secure.

When looking into which currency to purchase, consider factors such as how much money you have available and what kind of return you would like on your investment.

Now Start Cryptocurrency Trading on an Exchange

It is important to trade with caution. When you are ready to start trading, you will need to place an order. You can place a buy order, which will be executed when the price of the cryptocurrency you are buying reaches the amount you have specified. Alternatively, you can place a sell order, which will be executed when the price of the cryptocurrency you are selling reaches the amount you have specified. Once your order is completed, you can see it in your order history.

Choose a Wallet to Store Your Cryptocurrency

It is essential to choose a reliable crypto wallet when storing your coins. Different wallets provide unique features and usability, depending on the individual needs of their users.

The best way to store crypto is by choosing a cryptocurrency wallet. A good crypto wallet would be a cold storage wallet like a hardware wallet or paper wallet, but if you’re looking for a more convenient option, then go with software wallets like MyEtherWallet, Exodus Wallet, Jaxx Wallet, and Electrum Wallet.

This step is essential for traders who want to store their crypto for a long time. Otherwise, it is OK to store your coin on an exchange if you trade regularly.

Is Crypto Trading Good for Me?

This is a tough question. It depends on what your goals for trading cryptocurrency are. If you’re looking for a high-risk, high-reward investment, then crypto trading might be a good idea.

On the other hand, if you’re looking for a low-risk investment with more stability in the market value of your investments, then it might be better to stay away from crypto trading and stick with more traditional investments.

Is Crypto Trading Bad for Me?

It is also a tough question. Because cryptocurrency trading isn’t for everyone. It can be complicated, risky, and stressful. However, if you do your research, trade carefully, and take the right steps to manage risk, trading crypto could work out well for you.

If you’re interested in exploring the world of cryptocurrency trading but don’t know how to start, then try to learn from various sources. There are many academics like Binance, Bybit, Huobi, CoinMarketCap, and CryptoSwami that teach you everything from finding good crypto exchanges and wallets to understanding crypto trading.

Conclusion

Crypto trading is all about making money. And you can make profit with cryptocurrency trading, but there are risks. If you’re interested in making profit with cryptocurrency, you’ll need to decide which type of cryptocurrency trading makes sense for you.

If you want a hands-off approach and are willing to risk losing your initial investment, then buy and hold might be your best bet. However, if you want an active involvement in your trades, then a more aggressive strategy might work better like perpetual or future trading.

There is other some ways you could invest in cryptocurrency, like mining it or staking it, which could be more lucrative than just buying and holding. However, you need to know the risks before taking any action.

The most important thing is to understand how a cryptocurrency works and what type of trade you’re taking part in.