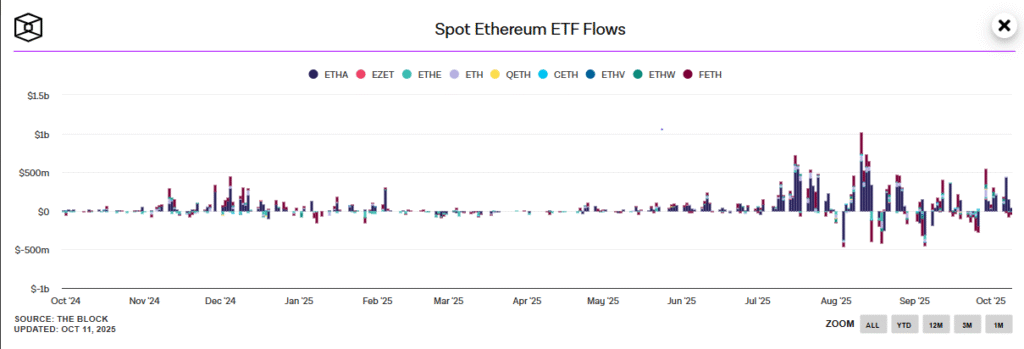

Institutional Ethereum ETF activity shifts as BlackRock clients sell $80M and inflows pause after a $2B streak, with Fidelity seeing the largest outflow.

BlackRock Client Sells $80M in Ethereum ETFs

BlackRock clients sold $80.2 million worth of Ether today, representing a substantial outflow from the asset management firm’s spot Ethereum ETF products.

On Thursday, U.S. spot Ethereum ETFs saw net withdrawals of $8.7 million, ending an eight-day inflow streak that had brought nearly $2 billion into the funds.

Fidelity’s FETH led the outflows on Wednesday, with $30.3 million exiting the fund. Bitwise’s ETHW, VanEck’s ETHV, 21Shares’ CETH, and Invesco’s QETH also recorded losses. In contrast, BlackRock’s ETHA stood out as the only fund with positive inflows, adding $39.3 million and extending its nine-day total to $1.4 billion, according to data from The Block. The remaining funds saw no activity.

Ethereum ETFs have allowed for active trading adjustments as institutions respond to market volatility. This selling activity illustrates how traditional financial institutions are using these assets to manage their exposure to the blockchain network, which supports decentralized finance and layer-2 scaling solutions.

Despite occasional sell-offs, institutional investors such as BlackRock continue to offer Ethereum exposure to clients, reflecting the growing integration of blockchain assets into mainstream finance.