Bitcoin and Ethereum ETFs inflows are again making headlines. As of the latest data Bitcoin ETFs have recorded net inflows of a total of $477 million net inflows. Markedly enough, no single one of the dozen Bitcoin ETFs had a net withdrawal, and that is a clear indication of increased institutional confidence and a revival of retail interest.

It is a boom after weeks of great Bitcoin currency performance and a wider adoption of digital currency by traditional investors. The regularity in the inflows at all the issuers indicates a market that is not only bouncing back but also maturing in terms of its distribution of capital towards crypto exposure.

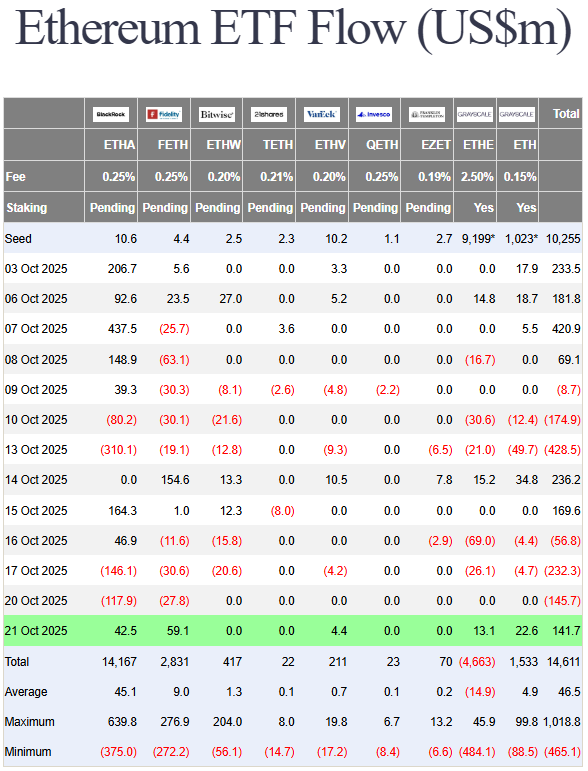

Ethereum ETFs Follow with $142 Million Inflows

Spot Ethereum ETFs are overheating and record a total net inflow of a hundred and forty-two million dollars, there is however no outflow recorded in all the nine ETFs currently listed.

The power of Ethereum is its growing utility: decentralized finance (DeFi) and tokenization to the following generation of blockchain apps. The ETF inflows indicate that institutional investors are now beginning to perceive Ethereum not only as a speculative asset, but as existing digital infrastructure of the future financial system.

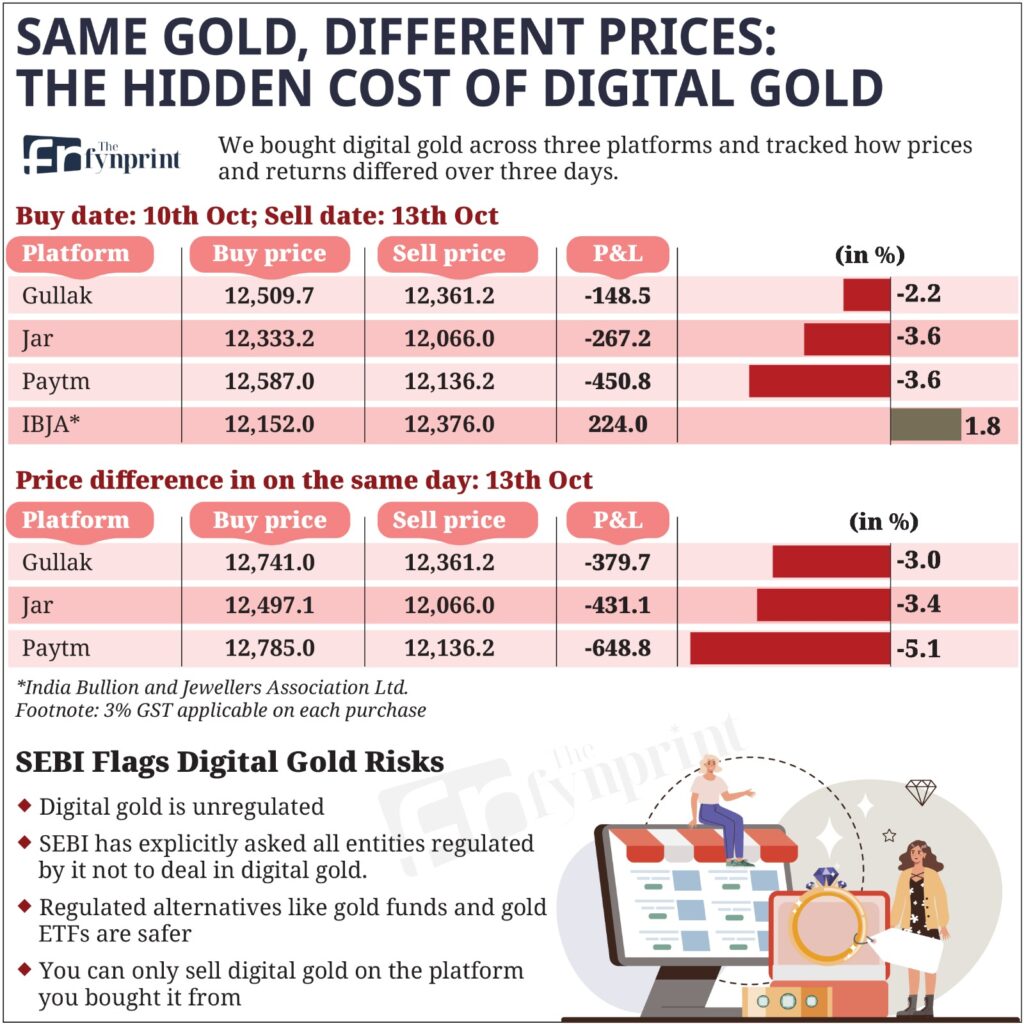

Is Gold ETFs Still the Safer Play?

Although the Bitcoin and Ethereum ETFs inflows is overtaking, Gold ETFs are still a strong tool amongst conservative investors. They are inexpensive, less risky and more secure and can be considered as that particular option to be chosen by any investor online without the fluctuation that is inherent in digital assets.

Gold has been considered as a store of value at all times: when the markets veer, it has been considered safe. Conversely, Bitcoin and Ethereum remain a subject of macroeconomic challenges and regulatory supervision albeit gaining some legitimacy. Gold remains the standard to investment security and predictability to investors who are primarily interested in these criteria.

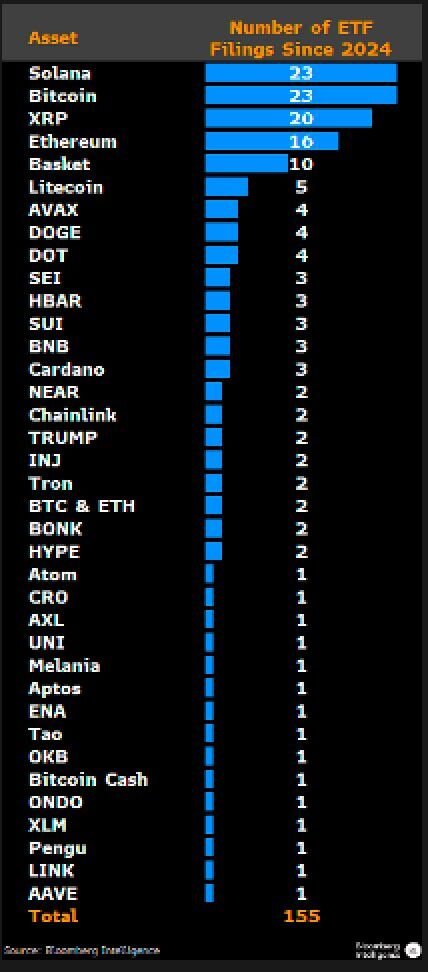

155+ Crypto ETF Applications Already Filed

The market of crypto ETFs is rather young, yet the growth is rapid. Bloomberg reporter Eric Balchunas writes that apart from Bitcoin and Ethereum ETFs inflows, there are already over 150 crypto ETF applications out there, following 35 different digital assets – Bitcoin and Ethereum, or Solana and XRP.

It is estimated that in the coming 12 months, roughly 200 and above crypto ETFs would be launched in the market, according to Balchunas. Should that occur, it will be one of the most aggressive ETF take-up periods in financial history.

What This Means for Investors

The great influx into Bitcoin and Ethereum ETFs is not the sign of a momentary optimism but the sign of a long-term pattern of altering a worldwide portfolio approach. With the introduction of crypto exposure by financial institutions in the form of regulated ETF vehicles, digital assets are becoming commonplace investment vehicles.

Nevertheless, risk versus reward should be considered by investors. The boom of gold ETFs cannot be compared to crypto, and their consistency still leaves a balance in portfolios.