Bitcoin plunged below $113K amid the crypto liquidation 2025 event, with over $19 billion in leveraged positions wiped out in 24 hours.

Dogecoin Founder Reacts to Crypto Liquidation 2025

Billy Markus, the co-founder of Dogecoin and a prominent figure in the crypto community, shared his thoughts on the market’s steep decline during “Uptober” and the resulting crypto liquidation 2025 event.

In a message on X (formerly Twitter), Markus, also known as Shibetoshi Nakamoto, criticized the excessive hype surrounding Uptober, a month historically associated with positive momentum in digital assets. He argued that misplaced exuberance and speculative leverage contributed to the crash.

His comments came as experts labeled ‘crypto liquidation 2025’ the largest liquidation event in cryptocurrency history, wiping out billions in leveraged holdings and shaking the broader digital asset market.

Trump’s Tariff Triggers Crypto Liquidation 2025

Trump’s tariff policies triggered the recent market downturn, contributing to the crypto liquidation event of 2025. New U.S. tariffs and export controls targeting China caused a sharp decline this week.

Trump’s announcement of a 100% tariff on Chinese imports and software export restrictions sparked panic in global markets, with cryptocurrencies taking the hardest hit.

Bitcoin, which hit an all-time high above $125,000 earlier this week, dropped more than 12%, falling below $113,000.

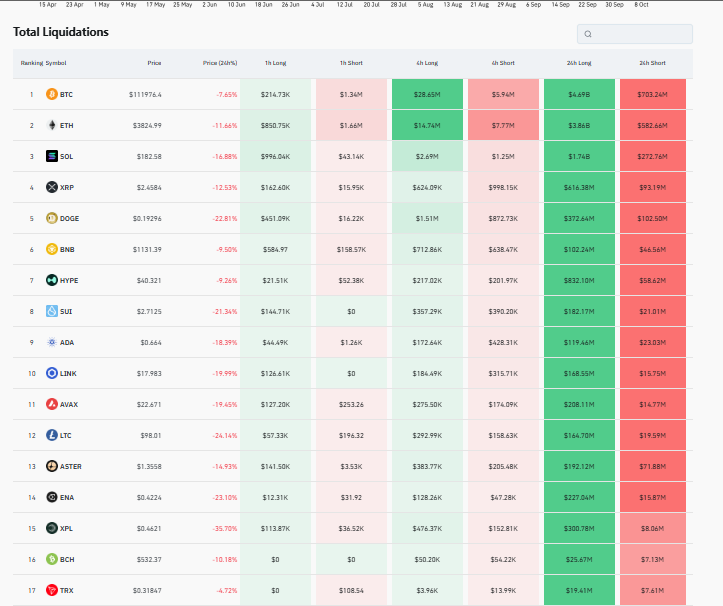

Coinglass data shows that liquidations wiped out over $19 billion in leveraged positions in the last 24 hours, impacting more than 1.6 million traders worldwide. Over $7 billion in liquidations occurred within a single hour on Friday, signaling an intense wave of forced selling.

Despite the turmoil, industry leaders urge calm. Michael Saylor, CEO of MicroStrategy, reaffirmed his confidence in Bitcoin, emphasizing that volatility is part of its long-term growth.