The Bitcoin market recovery is taking place as October 26, 2025 approaches, although weeks of turbulence happened before. Bitcoin, currently in the range of $114,000, is seen to stabilize as the hypocritical force is reduced, and the conviction over the long-term returns quietly by not making a splash.

STH Panic Ebb and the Post Crash Exhale

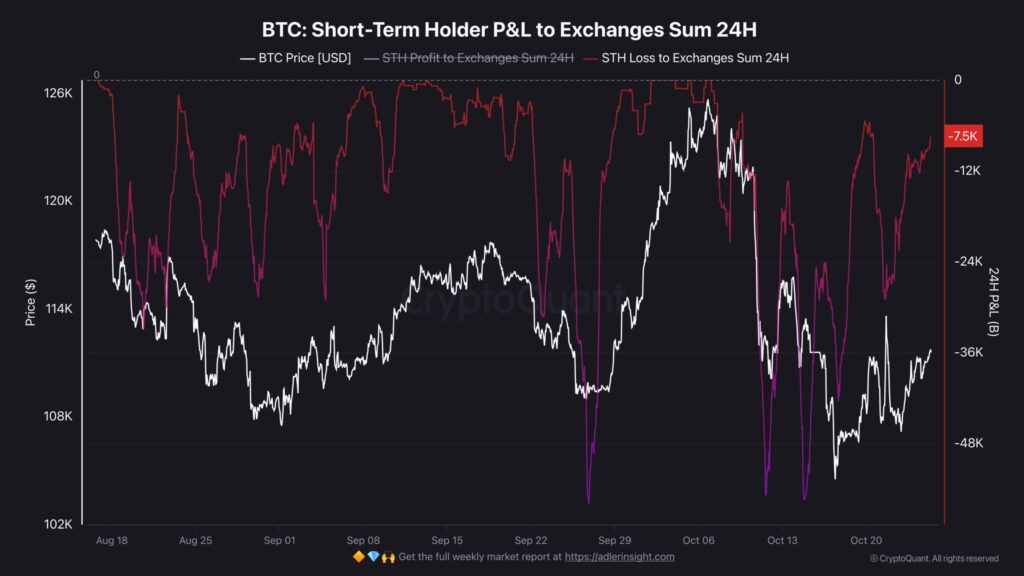

The most accurate idea of the emotional reset in the market is the Short-Term Holder (STH) loss-to-exchange metric .Since the peak of the panic of -48,000 BTC in the middle of October to less than 10,000 BTC today, its crash was an indication that the stampede of selling at a demand is mostly over.

This cooling-off process is a significant milestone in the recovery that has been occurring in the Bitcoin market since the speculative crowd ceased to sell the market, and in their silence the long-term holders (LTHs) and institutional investors are getting room to re-price the market.

Nonetheless, this is not an indication of the celebratory mood, rather it is a marker of balance. The existing tranquility may indeed be the source of renewal or may merely be the eye of a wider turn that is yet to occur.

CDD Heatmap Ensures Confidence of the Long-term Holder

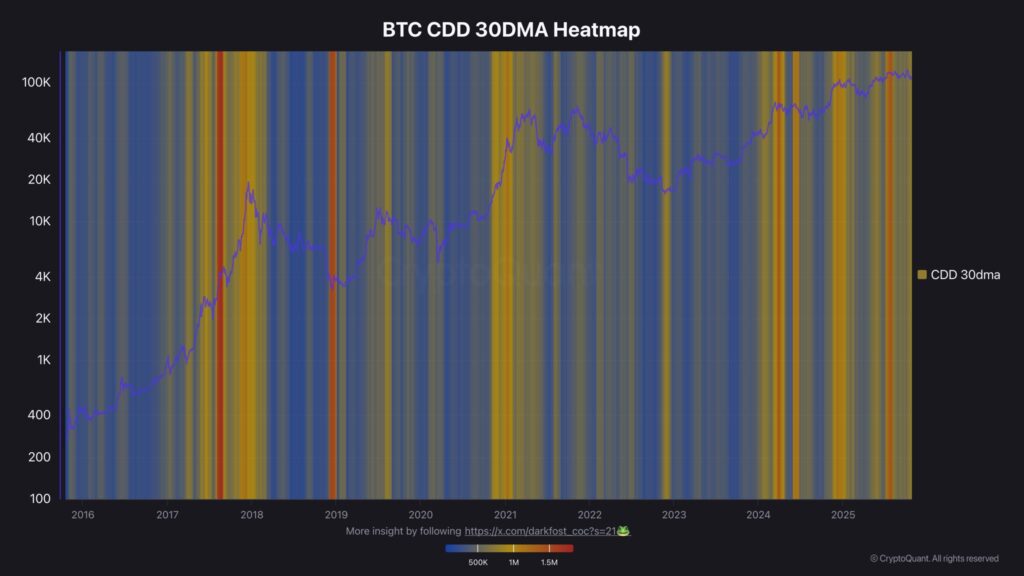

The story of the Bitcoin market rebound is enhanced by viewing it through the CDD (Coin Days Destroyed) 30DMA heatmap, which measures the behavior of long-term holders when forced.

The heatmap is now amber, not red, an indication of restrained belief and not of panic or delirium. There is also a dormant supply that is slowly waking up and demonstrating that LTHs are moving their holdings around, not selling them off.

These amber phases are traditionally indicators of equilibrium and recovery – of market cleansing following a purge, whereby belief is transferred between the patient and the ready silently.

83.6% Percent of Total Bitcoin Supply in Profit: A Strong Foundation

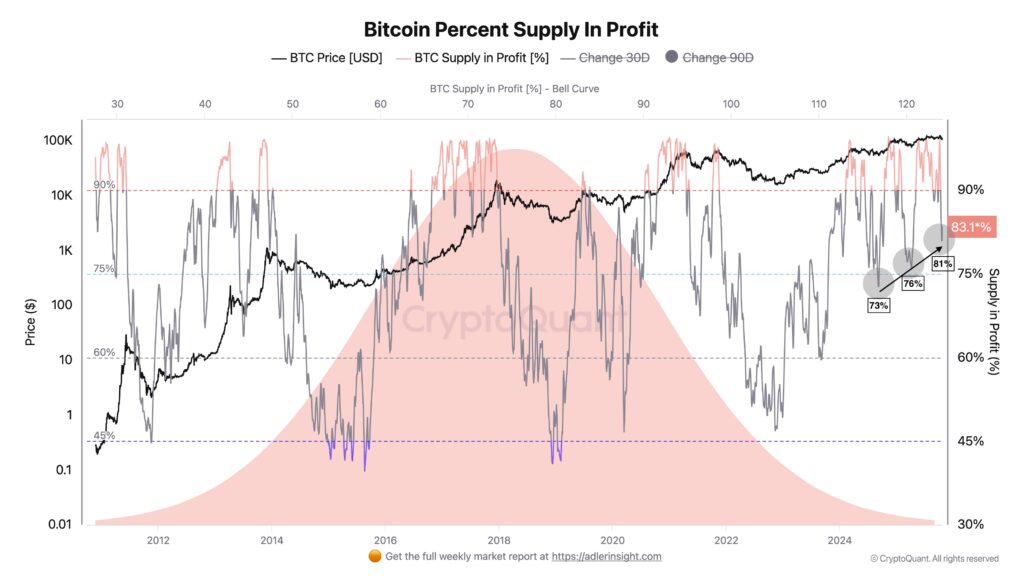

The profit ratio is another indicator that the Bitcoin market is regaining its status as the current ratio is 83.6%. This number suggests that the majority of BTC is already in profit over 4/5, a mark that is associated with stability, rather than a mania.

This era is defined by institution absorption and retail reticence unlike the overheated bull cycles of the era. It is a more decent, adult stage, in which faith prevails over lust, and long-term hoarding carries on beneath the ground.

Bitcoin Market Recovery is a Sign of Maturity and Not Mania

The narrative of October does not pertain to a raptureous fit-out-it is all about equilibrium. Having survived the liquidation storm in mid-month, the Bitcoin market information endangers depicting a silent recuperation image.

The current phase of a Bitcoin market recovery is evidence of an evolving ecosystem, with a cycle characterized by long-term belief, institutional engagement, and structural well-being.

To become another leg high or stay in a stalemate phase, there is no doubt that Bitcoin has been taught to breathe again and that even rate could become the surest indicator to date of long-term recovery.