Solana Staking ETF has helped Crypto investment make a big step. The first-ever Spot Solana ETF has been approved by the U.S. Securities and Exchange Commission (SEC) as another step in the mainstream acceptability of blockchain-based assets.

The fund Mass (ticker: BSOL) will be the first U.S. exchange fund to provide an investment portfolio that gives 100% direct exposure to spot Solana (SOL).

This occurs amidst the predicted Altcoin Season that might start in November, which would precondition a new push in the entire digital asset arena.

What Is the Bitwise Solana Staking ETF (BSOL)?

Bitwise Solana Staking ETF (BSOL) provides a regulated introduction of traditional investors to Solana, a rapidly growing Layer-1 blockchain in the world.

In contrast to earlier crypto-based funds, BSOL is staking its assets at 100% so that investors can experience the benefits of participating in the average staking reward of 7%+ of Solana, without the hassle of having to manage wallets or validator nodes.

- Bitwise is of the opinion that the product will:

- offer total immediate exposure to spot SOL.

- Optimize the average yield of Solana of 7%+ at stake.

- Stake everything by Bitwise Onchain Solutions which is run by Helius Labs.

- Waiver of a 0% fee in a short period of time.

This framework helps not only to bridge the divide between traditional finance (TradFi) and decentralized networks but also to emphasize the increased contribution of Solana as a platform of capital markets on chain.

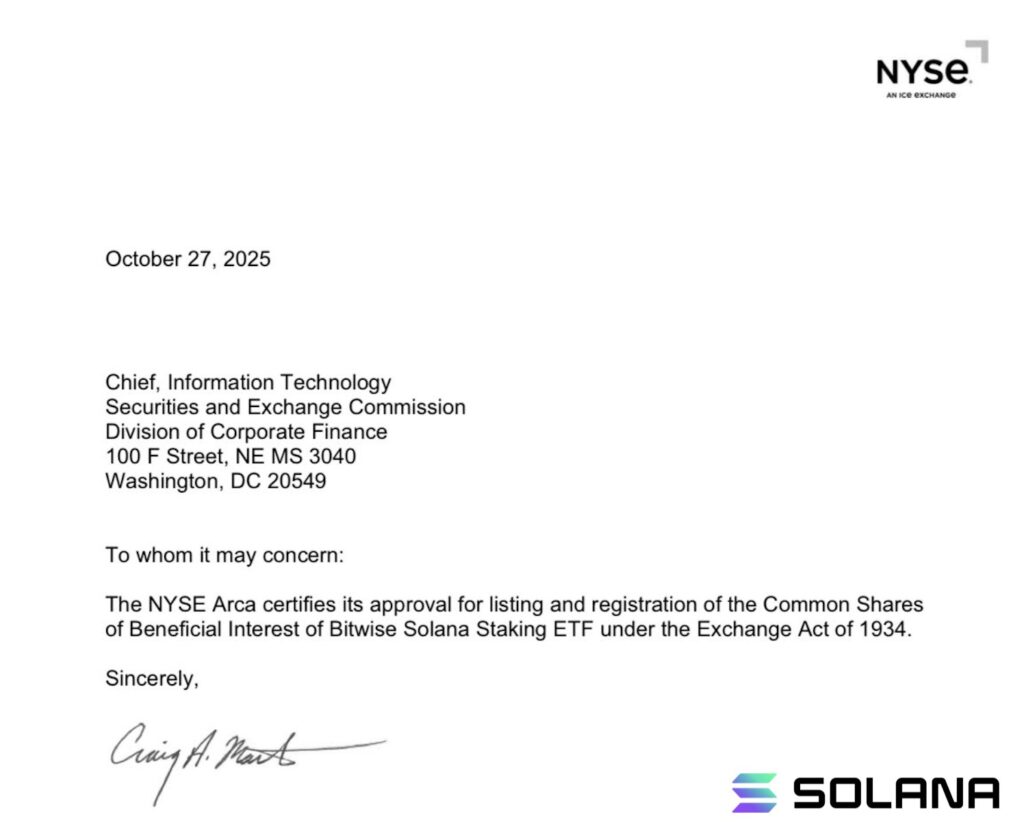

The Listing of BSOL is Certified by NYSE Arca

The Bitwise Solana Staking ETF was listed and registered in the NYSE Arca exchange and is officially ready to start trading.

The certification is one of the major regulatory measures that will prove that Solana is a legitimate investment class in terms of U.S. financial law. With regulated ETFs investors will now be able to be exposed to the growth potential of Solana and get increased exposure through an investment offering that is regulated by a company that is easy to invest in as either an institution or as a retail investor.

This launch, as Bitwise notes, is an indicator of the increasingly held view that Solana is at the right place at the right time: a blockchain that can efficiently allow scaling decentralized finance, NFTs, and capital markets.

The Solana Staking ETF is Important Because of the Following Reasons

Solana Staking ETF is not just another investment product; it is an indicator that they trust the network of basics of Solana and its sustainability in the long term.

Here’s why these matters:

Mainstream Accessibility: The accessibility to Solana is now available to investors via conventional brokerage accounts.

Passive Income through Staking: The staking feature will enable BSOL to indirectly share staking rewards with investors that deploy 100% of its assets on Solana.

Reduced Barriers to Entry: No wallets or personal keys needed and can be on chain controlled.

Reg Landmark: The ETF approval has the potential to create a path to other such products that are based on other major Layer-1 networks.

To the majority, this is a symbol of institutional acceptance of Solana picking up the pace after Bitcoin and Ethereum ETFs.

The Ways of Solana to the Mainstream

The use of Solana in real-life applications has a great potential as the blockchain is high throughput, has low fees, and an ecosystem developing in terms of DeFi, NFT, and infrastructure projects.

Bitwise thinks Solana is the next step in the history of blockchain-capital markets going on chain in all its interactions.

Through $BSOL, they will now have the ability to either cash in on the potential of network growth as well as receive the average network rewards of 7% through a straightforward, regulated instrument.

The creation of the Bitwise Solana Staking ETF, named BSOL, represents a pivotal event in the history of Solana and the entire crypto community in general. Solana as an entity moves into the mainstream investment environment, this product may be able to reinvent how institutions perceive staking-based returns and blockchain involvement.

The decision could not have been chosen more appropriately since November is historically the beginning of the Altcoin Season. This could be the second crypto boom but this time, Solana may be on the forefront.