Chainlink is battling to retain a major price point at the moment. The new decrease in price challenged the determination of any investor. But, on closer examination of the market charts and wallets of the largest holders, there is an indication of a strong defense being launched. This is a critical point that will determine whether LINK will be able to recover or fall to the lower support levels.

Major Chart Levels and Price Rejection

Link has good strength in its latest price recovery. However, the rally was seriously blocked just below $20.27. Such a resistance level is the most significant one to be observed. The price was pushed back decisively at the price of $20.

Thus, bulls should break the present support range at approximately $17 to make another break. A close above $17 is crucial to stability in case the buying pressure succeeds.

On the other hand, once the price goes down to less than the $17 zone, the next probable target to further fall is at the price of $15.50. Overcoming the barrier of $20 successfully might easily shoot LINK to $22.71 and later to $26.00.

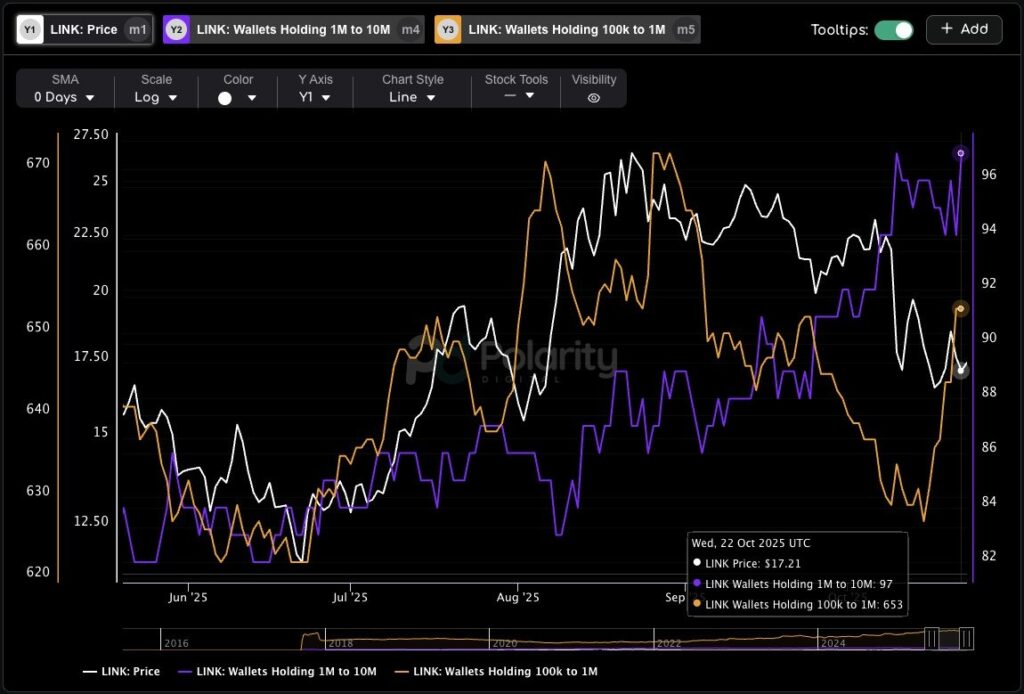

Whales Are Buying the Dip

However, it is interesting that the biggest wallet holders are taking so much confidence at the current prices. These whale wallets with a deposit of $100,000 to $10 million in LINK are actively compounding their possessions. Moreover, the wallets with the biggest amounts, $1 million to $10 million in LINK, are also contributing to supply.

This buildup indicates that they view the recent decline as a tremendous purchasing agenda. Thus, this influx of purchases among the largest players in the market provides the $17.00 support level with the much-needed strength.

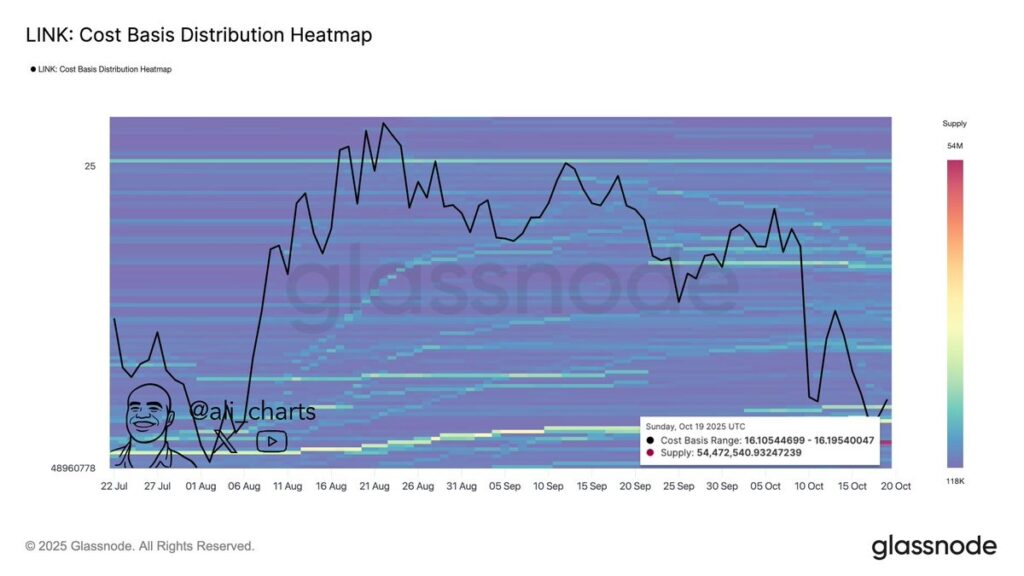

Major Support Confirmed Cost Basis

This bullish whale action is supported by the cost basis distribution heatmap. This chart indicates the last price that the supply has been moved. As shown in the map, there was a significant acquisition of supply between the range of $16.10 and $18.19.

This huge investment group serves as a solid foundation. In other words, large shareholders are already in the red in case the price drops further. In this way, they will fiercely protect this domain.

The strength of technical support and the activity of whale purchases are such that the existing level of $17.00 is an essential frontline of the short-term history of LINK.