Investing in non-fungible tokens (NFTs) can provide exciting earning opportunities, but it also comes with significant NFT risk. Before putting money into NFTs, it is essential to understand the different risks involved and how to protect yourself from them. This guide highlights the most common NFT risks and practical strategies to stay safe in the market.

Over the past few years, crypto trading has grown rapidly, and NFTs have emerged as a surprising trend within it. However, this growth also led to controversy. If the NFT risk factor is ignored and scams or failures continue, NFTs could harm the reputation of the entire crypto industry.

Many people believe NFTs are a completely new concept, but that’s not true. If you look back a few years, you’ll find games like CryptoKitties, which introduced the “play-to-earn” model similar to today’s NFT games. The only difference is that NFTs have become far more infamous due to their volatile reputation and high-risk nature.

These concerns can’t be ignored. People often ask, “How did something so innovative become so controversial?” or “Why should anyone invest in NFTs with so much uncertainty?” Such questions make even experienced crypto enthusiasts pause.

That’s why today, we’ll explore why NFTs suddenly fell into this situation and why investors are becoming cautious. While investing in NFTs does have potential advantages, the growing NFT risk makes it equally important to understand the downsides before committing your money.

What Are the Some Common NFT Risks

Investing in NFTs may seem exciting, but it comes with unique challenges that every buyer should understand. Here are some of the most common NFT risks include price manipulation, fraud, high volatility, limited market liquidity, ownership issues, and regulatory uncertainty. More details follow.

Price Manipulation – A Major NFT Risk

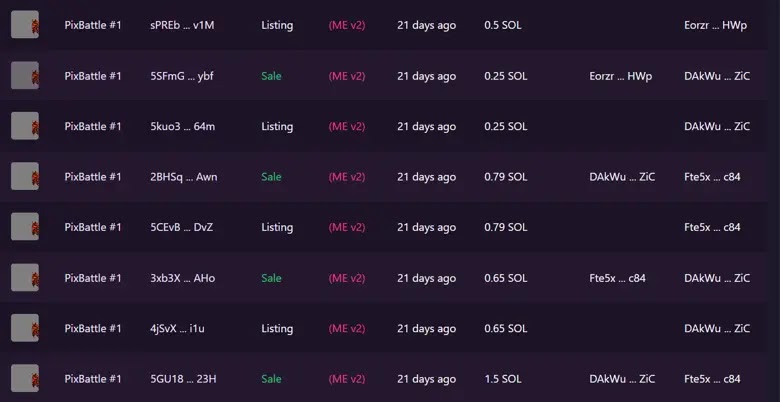

One of the most common ways scammers exploit the NFT market is through price manipulation. This method is simple yet effective. A scammer creates multiple accounts, uploads NFTs from one account, and then buys those same NFTs using another account. By repeating this process, it creates the illusion that demand for the NFT is rising, which artificially inflates its price. In reality, no genuine market activity is happening.

This deceptive practice is known as wash trading. The primary goal of wash trading is to exploit NFT marketplaces with little to no risk for the scammer. Research shows that wash trading is particularly widespread on platforms that offer reward systems, such as LooksRare. It is also common on marketplaces where NFTs can fetch higher prices, like OpenSea.

Wash trading is when the buyer and seller in a transaction are the same people or two people colluding. It’s banned in conventional financial markets because it misleads the rest of the market about the true level of demand, distorts prices, and entices others to trade on fake information. Read more.

What makes this NFT risk more concerning is the fact that only two or three accounts are often responsible for more than 70% of wash trading activity. This means a small number of manipulators can distort the entire market, misleading new investors into believing that an NFT is more valuable than it truly is.

Popularity Dependence – An Overlooked NFT Risk

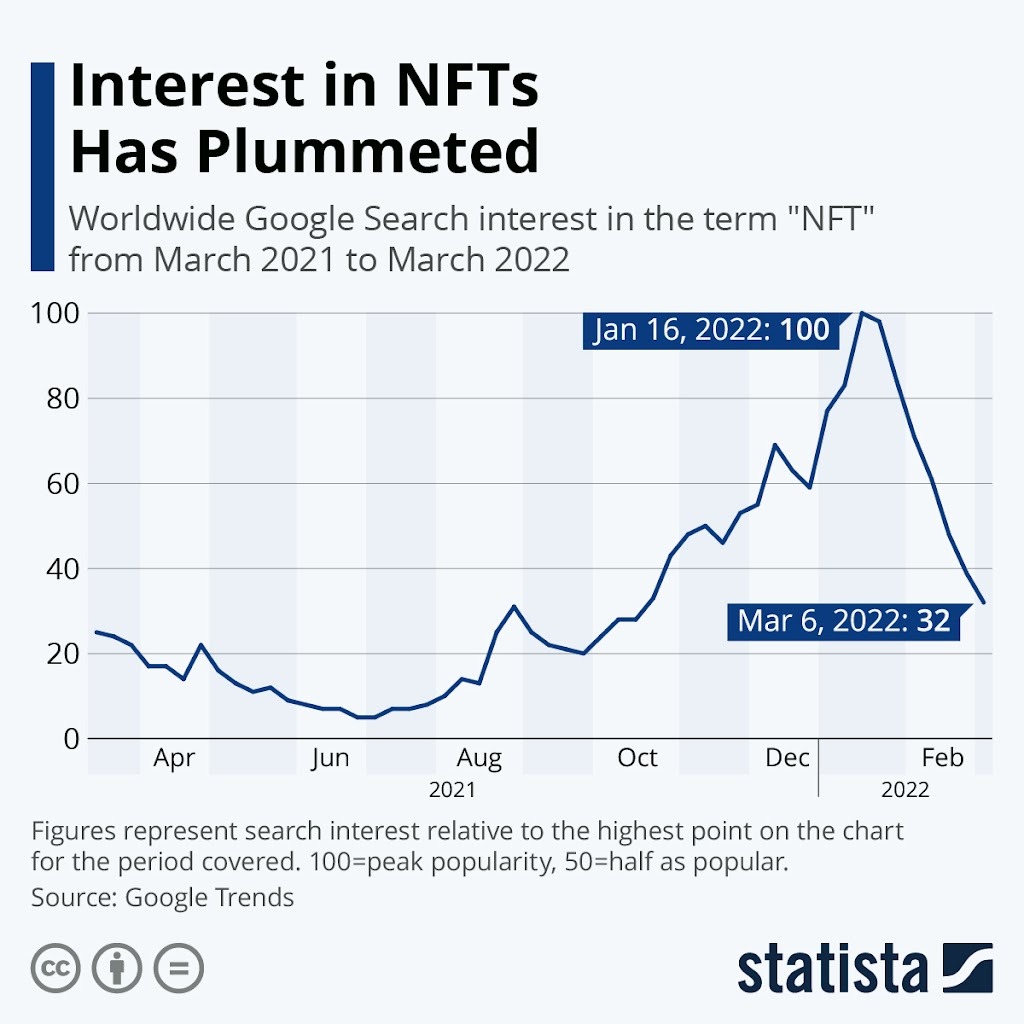

Popularity plays a major role in determining the price of any NFT. For example, when someone mentions NFTs, most people immediately think of the fancy-looking monkeys from BAYC (Bored Ape Yacht Club) or the pixel-styled characters from CryptoPunks. These collections became cultural icons, and under the influence of this hype, their prices skyrocketed.

However, this dependency on popularity also creates a significant NFT risk. When the hype fades and the demand slow down, these same NFTs often struggle to sell. As a result, their prices crash, leaving investors frustrated and fueling negative sentiment toward NFTs as a whole.

High Volatility – A Core NFT Risk

Many investors avoid cryptocurrency because they find it too risky, yet they still consider buying NFTs. But here’s the truth: if crypto sits high on the risk scale, NFTs rank even higher. While cryptocurrencies can usually be sold quickly on exchanges, NFTs don’t offer the same liquidity. This makes them harder to sell when market conditions turn against you.

Another reason volatility is a major NFT risk is that NFTs are directly tied to crypto prices. Most NFT transactions happen in ETH, BNB, or SOL. So, if the value of these cryptocurrencies drops, the value of NFTs usually falls as well. The problem becomes even worse when demand for NFTs themselves declines at the same time.

Ownership Risk – The Hidden NFT Risk

Just like cryptocurrency, NFTs come with their own storage and ownership challenges. Unlike coins or tokens, you often cannot store NFTs securely in a non-custodial or cold wallet, which creates a serious NFT risk. To buy, sell, or trade NFTs, you rely on centralized platforms such as OpenSea.

But what happens if one of these platforms suddenly shuts down, gets hacked, or becomes unavailable? For example, if OpenSea—currently one of the leading NFT marketplaces—were to stop functioning, your ability to access or trade NFTs could be severely affected. In many cases, the data and access points are hosted on the platform’s servers, not fully secured on the blockchain.

Although this problem can be solved if NFTs come on a decentralized platform.

AI-Generated NFT Art – A Growing NFT Risk

Artificial intelligence has taken over many aspects of the internet, with tools like ChatGPT becoming widely recognized. Similarly, AI is now being used to create digital artwork that often gets minted and sold as NFTs. At first glance, buying such an NFT may seem exciting, but there’s a hidden NFT risk investors should not ignore.

The real issue is not that the art is AI-generated but that of copyright ownership. AI models don’t usually create entirely original works; instead, they generate new images by blending elements from existing content available online. This means an AI-generated NFT might contain parts of copyrighted material without clear permission from the original creator.

For buyers, this raises serious concerns. No one wants to invest in an NFT only to discover later that it may violate copyright laws or lack true artistic authenticity. Until proper regulations and verification systems are in place, AI-generated NFT art will remain a controversial and risky area of the NFT market.

Government Regulation – An Uncertain NFT Risk

So far, most governments have struggled to regulate cryptocurrencies, and since NFTs are built on blockchain technology, they face even greater uncertainty. While it’s not correct to say governments will never regulate NFTs, as of now, there is little clarity.

In many countries, NFTs are being loosely grouped under the same category as cryptocurrencies when drafting regulations. However, there is still no clear framework that defines whether an NFT should be considered a digital asset, a security, or a commodity. This lack of clarity creates a serious NFT risk for both creators and investors.

Experts suggest that governments are cautious because NFT regulation must address complex issues such as copyright, trademark protection, and digital ownership rights.

Limited Market Liquidity

The NFT market is still in its early stages, which means overall liquidity remains limited. Unlike cryptocurrencies that can be sold almost instantly on exchanges, NFTs often lack an active pool of buyers and sellers. As a result, if you need to sell an NFT quickly, it may take longer than expected.

The problem is made worse by the fact that many new participants enter the NFT space with high return expectations but often lack the technical knowledge to navigate such an illiquid market effectively.

For long-term investors, this highlights the importance of patience and thorough research. For short-term traders, however, the risk of being stuck with an NFT that no one wants to buy can be a major drawback.

Not Fast Tradable as Crypto – A Practical NFT Risk

If you have money, then obviously it doesn’t matter to you how fast or not tradable NFTs are because all you have to do is show off on your social media profile. However, for investors focused on profit, this lack of fast tradability is a serious NFT risk. In crypto trading, one just has to place an order, and the amount gets filled automatically, but in NFTs, the buyer and seller have to agree on a fixed price, which takes a long time. This risky trend of NFTs becomes a favorable condition for any investor not to invest money.

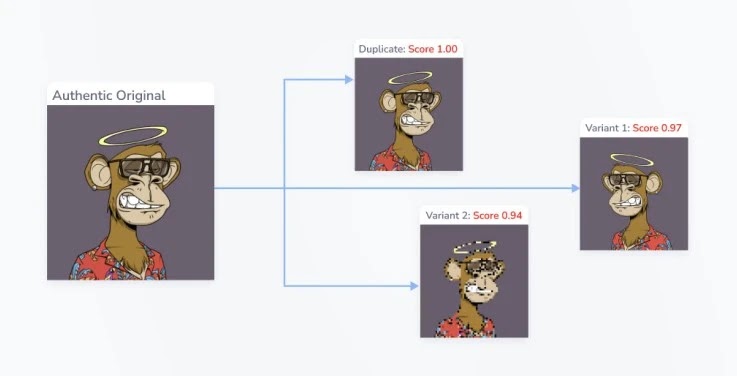

NFTs Fraud

Fake NFTs, copyright violations, and even misleading airdrops fall into this category. Scammers often impersonate well-known artists or celebrities, creating fake NFTs that look almost identical to genuine ones. For new buyers, it becomes nearly impossible to distinguish between real and fake.

This kind of fraud not only leads to financial losses but also creates serious NFT risk around intellectual property rights. Since many NFTs are linked to digital art, music, or collectibles, copyright infringement is a constant problem. Governments and regulators are finding it difficult to step in because of the complex overlap between blockchain technology and traditional intellectual property laws.

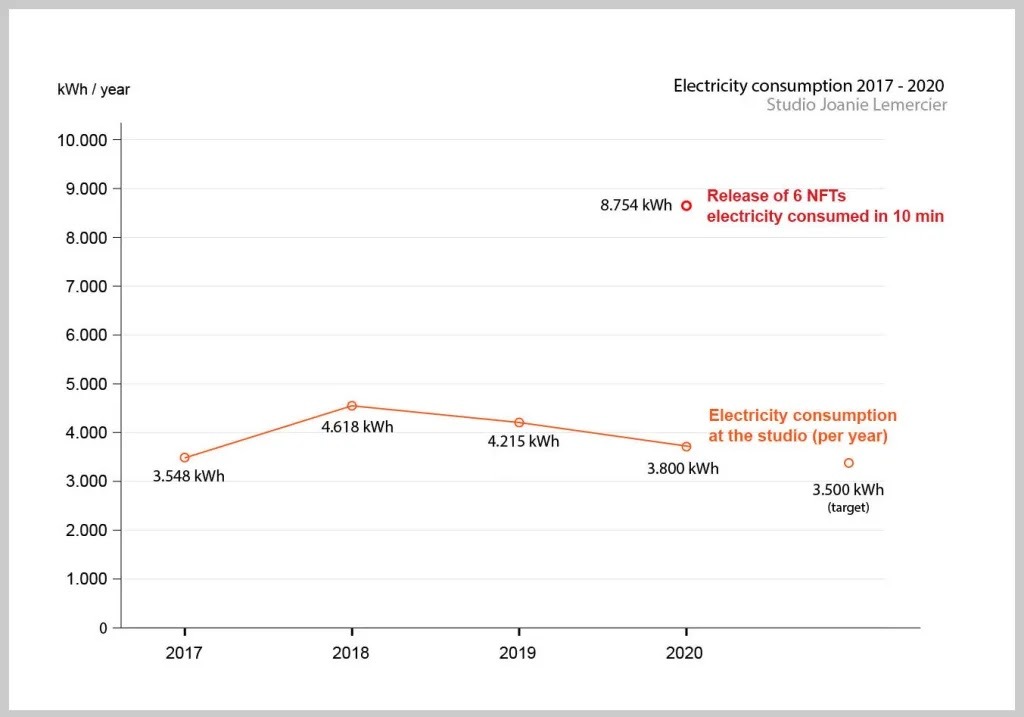

Not Environment Friendly

Poor Bitcoin is always criticized on the pretext of the environment, and the same thing is being done with NFTs. Although there is no precise calculation of how much energy NFTs consume, the debate often centers on the blockchain networks they rely on. For example, it has been estimated that a single Ethereum transaction could generate around 130 kg of CO₂, the same amount of energy a household might use in two to three weeks. However, this is an ethical problem, not a risk of NFTs, and keeping in mind this problem, the ETH network has shifted from proof of work to proof of stake.

Conclusion- Risk of Investing in NFTs

When it comes to NFTs, the risks are both technical and non-technical. The good news is that some NFT risks can be minimized by taking proper precautions, such as careful research, using secure platforms, and avoiding hype-driven purchases.

Among all the risks discussed, price manipulation and fraud stand out as the most dangerous. These can mislead even experienced investors and cause heavy losses. Still, like every financial instrument, NFTs have two sides: one risky and one full of opportunity.

Ultimately, whether NFTs are a risky gamble or a worthwhile investment depends on how carefully you approach them.