SEI Network has shown impressive technical trends and performance power in the recent past indicating that it may be on the way to a significant upward price action. The price behavior of the SEI token that has received the major interest of traders was a clear indication of a falling wedge structure.

This trend is commonly known in technical analysis, and it indicates that the long-term negative trend may be coming to an end and that a bullish reversal could be expected soon. Trading around $0.20, the price remained in this wedge and maintained key support levels despite closing down upon the trading ranges.

Therefore, should SEI manage to break and close above the upper trend line resistance of this wedge pattern, one might be able to initiate a significant upward surge on the attainment of higher price levels.

On-Chain Trading and Domination of Specialized Trading

Technical indicators showed that the price was reversing, but the underlying metrics of the network showed that it has specialized use in the market. The complex derivatives trading volume through the cumulative perpetual trading volume rose to an unprecedented high of over $38 billion.

This huge trading number showed that SEI succeeded in becoming a dedicated high-frequency, decentralized trading applications platform. The network core structure that was based on speed and efficiency made the environment very competitive among these traders.

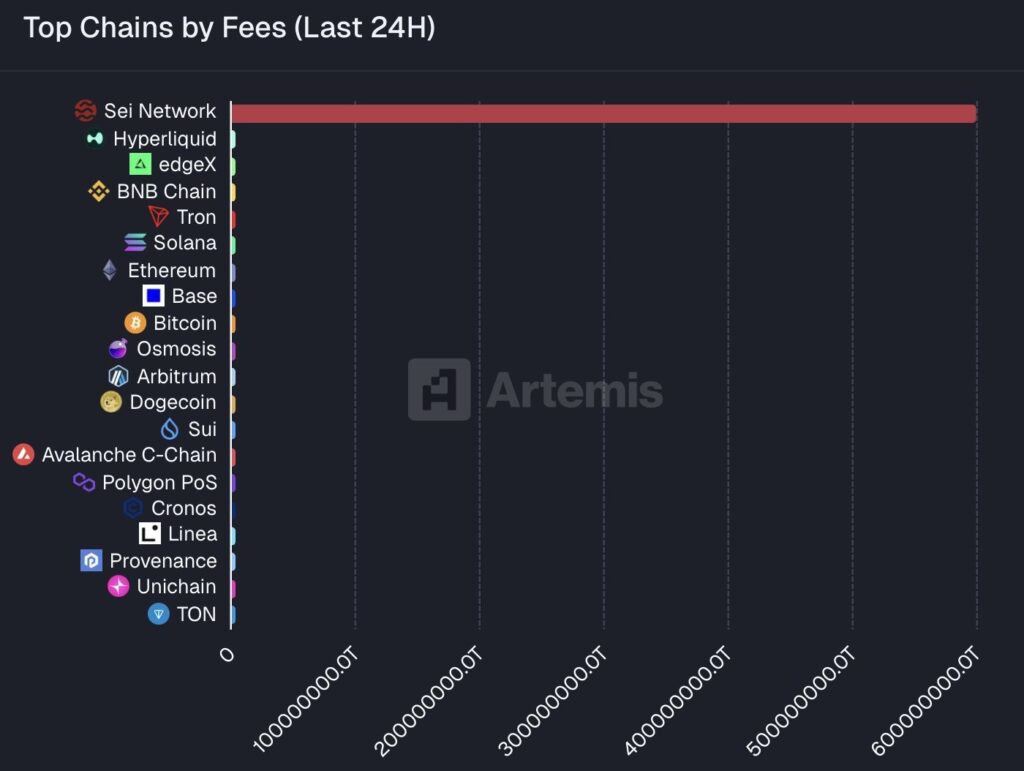

Moreover, such high activity was a disproportionate volume that the network was handling against its capital base. This narrowed momentum saw SEI at the top of the chain in fees collected within a given 24 hours in the past, proving its economic hegemony in a major market niche.

Operational Resilience and Capital Efficiency

The operational performance of the SEI platform was also impressive, which proved its stability during stress. More importantly, the network itself never really went offline, or even slowed down, when there was a significant Amazon Web Services (AWS) outage, which often resulted in mass disruptions of many centralized and cloud-reliant crypto initiatives.

This reliability was proven and provided a great level of confidence, showing that SEI succeeded in its decentralization strategy and uptime. This strength, coupled with the large volumes of trade, highlighted the high efficiency of the capital of the network.

Its technical advantage in financial applications was confirmed by the platform being designed to enable the user to gain about three to five times more value out of their capital than it was on competing networks.

Outlook of the Anticipated Breakout

The technical setup combined with proven operational might indicated that SEI was in a good position to grow in the future. A high probability of the successful breakout of the falling wedge could be succeeded by a major move toward a starting target zone of about $0.22.

Should this first momentum indeed work, then there would be a possibility of recovery towards a more ambitious goal of $1.15, as some assessments have determined over the potential of the pattern.

As such, the fact that the network had solid foundations, coupled with a clear indication of an imminent technical reversal, highly indicated that SEI was poised to establish itself as a significant player in the high-performance blockchain industry.