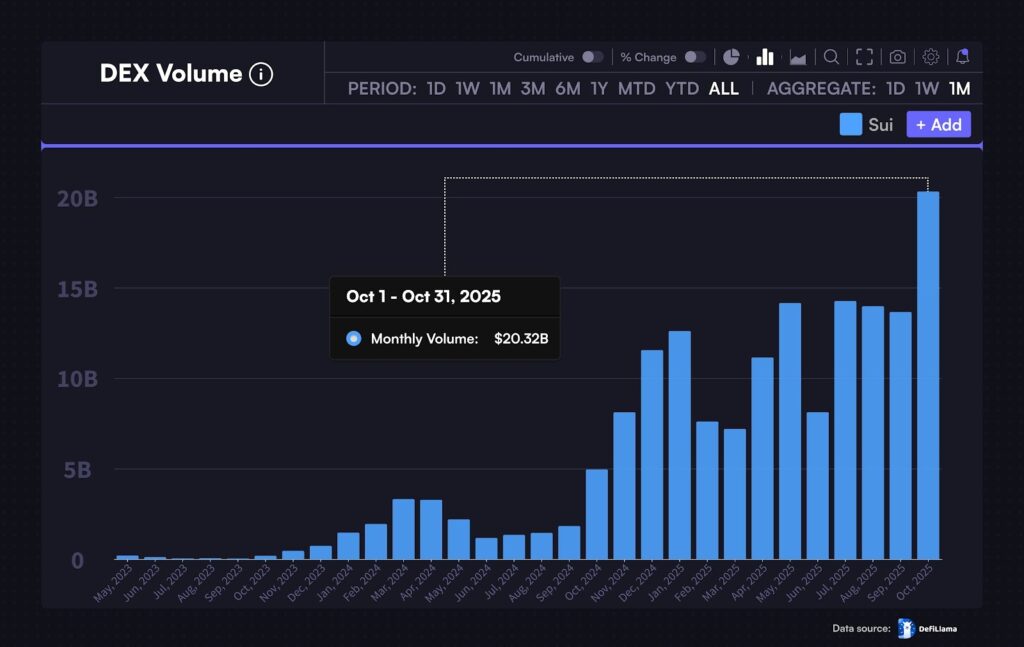

Recently, the Sui network recorded a historic milestone, as it reached a $20 billion monthly Decentralized Exchange (DEX) volume, the first time in the history of the network. This instant burst of on-chain activity made Sui one of the leading competitors to the best Layer-1 blockchains.

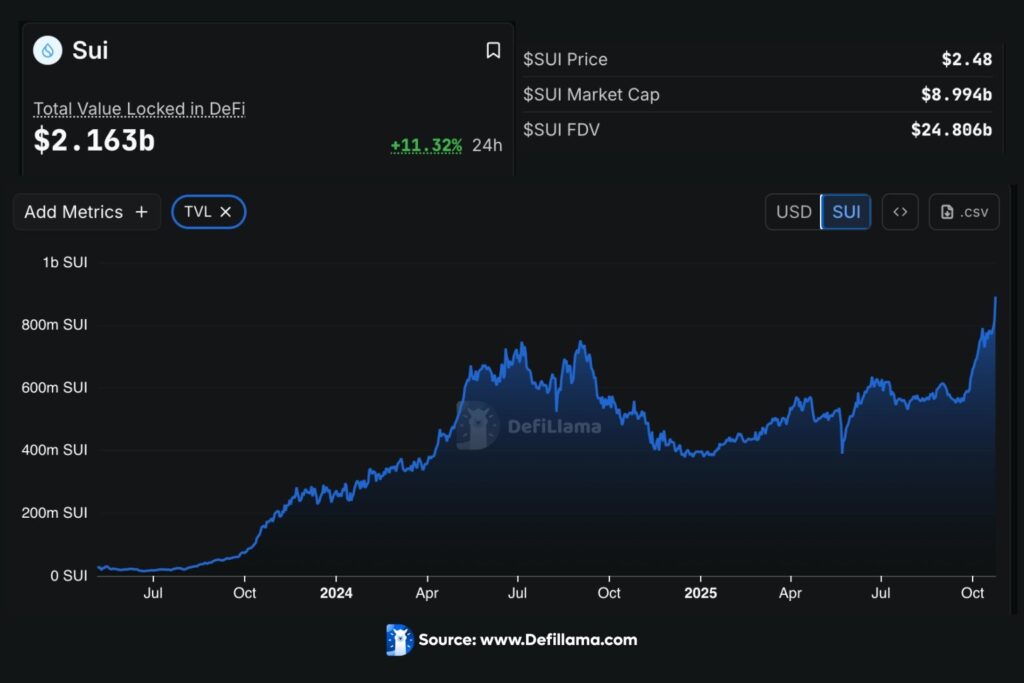

At the same time, the total value locked (TVL) in the ecosystem increased dramatically, more than 11.32 percent in 24 hours, bringing the total to $2.16 billion.

Such an overwhelming surge of basic growth exemplified the good momentum that was gaining momentum throughout the whole Sui chain, which made it possible that SUI was becoming a Layer-1 King.

On-Chain indicators are Bearing a Ropey View

The fast and historic expansion ensured the rising confidence in the technological building blocks of Sui. It is evident that the best decentralized finance protocols that have been run in the ecosystem experienced a corresponding increase in the TVL and the activity level.

This collective growth made a strong emphasis on the utility and the rise in use of the Sui network. As an example, the chart showed that the DEX volume of October 2025 was 20.32 billion in particular, which is a significant jump compared to other times. The SUI price itself was performing an opposite story despite the increasing strength of the network being at its peak.

Price Action Divergence in the Middle of Institutional Interest

In spite of the success in stores, bears still exercised a bearish pressure on the SUI token price. Technically the price did not manage to hold above one of the main downward resistance lines on the chart, which proves the position of the sellers as the dominant ones in the short run.

As a result, the existing price was uncomfortably in the middle channel that was continually pushing it towards the bottom of the support. This dramatic contrast between rising ecosystem fundamentals and falling price activity usually indicated a short-term market inefficiency.

To further reinforce the positive prospect, 21Shares submitted news of a major advancement to its prospective Sui Exchange-Traded Fund (ETF) with the SEC. The company has revised the filing with an in-depth staking model, which has the potential to bring on board income-oriented institutional capital.

Moreover, 21Shares formally appointed Nasdaq as the listing exchange of the ETF shares, which was a significant move that provided Sui with a great amount of credibility among the conservatives of the financial world.

Such an institutional interest combined with the explosive nature of the adoption process revealed that any continued movement below the existing support boundary was to become a temporary aberration.

Prospects: The Possibility of a Backlash

Finally, the combination of the all-time high $20 billions of DEX volume and the institutional support of the Nasdaq-traded ETF was a good reason to feel optimistic in the long-term perspective.

The short-term price cannot be that weak; it could be just a temporary technical correction, and it is an opportunity that the long-term investor has. With such an intense position in the network activity, the existing price that is already close to the lower support level might change direction.

Hence, the success of the SUI network also implied that a great breakout in the price is bound to happen when the negative technical forces have been exhausted.