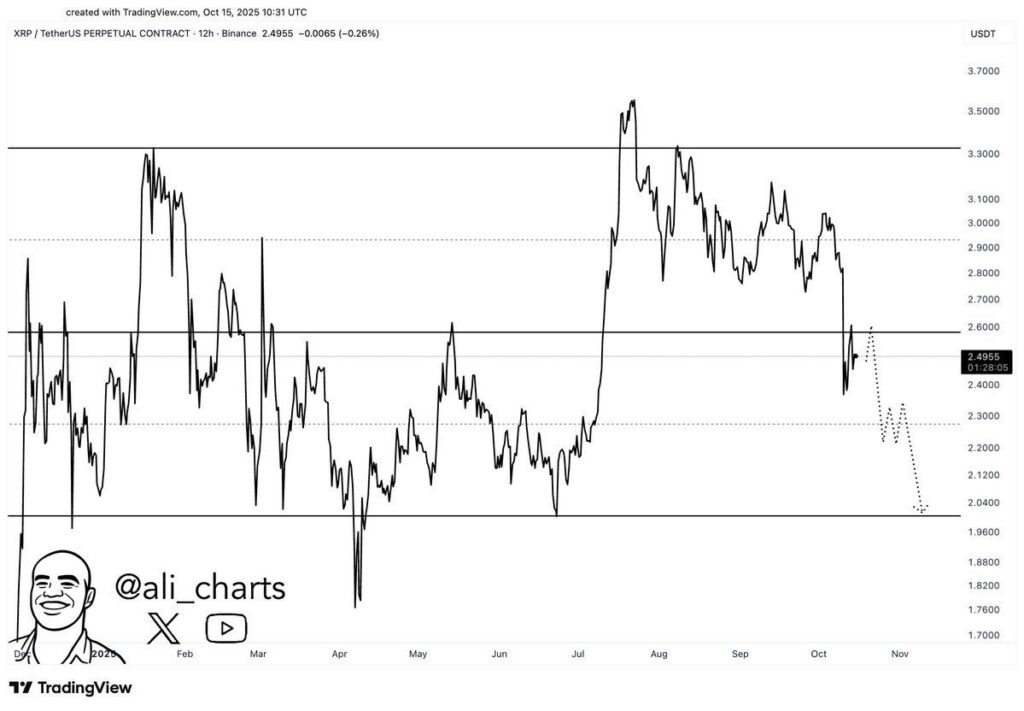

XRP is now trading at the $2.49 mark, as it has plummeted off a previous $3.30-level resistance. But its strong practical value indicates there is a serious shift that is about to take place. In particular, the chart pattern shows that the critical reversal level of the important support level of $2.00 may be retested before the possible reversal.

This is a momentum that is gaining traction due to the increased role of the digital asset as a cross-border payment leader that is fast and low cost. Thus, as the enterprise adoption and regulatory clarity have made significant breakthroughs that have given the industry a backbone, the price region of $2 is being carefully watched by the analysts as the next prominent move. Ripple was recognized as Core Tech at American Express blockchain system

The technology by Ripple is not merely a theory; it is already one of the essential elements in global finance. One of the most important scholarly findings that have been validated in a study in February 2023 is that American Express is deploying the blockchain infrastructure provided by Ripple.

This is a vital collaboration that demonstrates that the technology has the capability of facilitating real-time and effective cross-border transactions of a financial powerhouse. The integration offers strong validation, which affirms that the Ripple Net is a solution of choice in institutional money transactions that are of high volume. Such a real-world implementation is a tremendous trust in the whole XRP ecosystem.

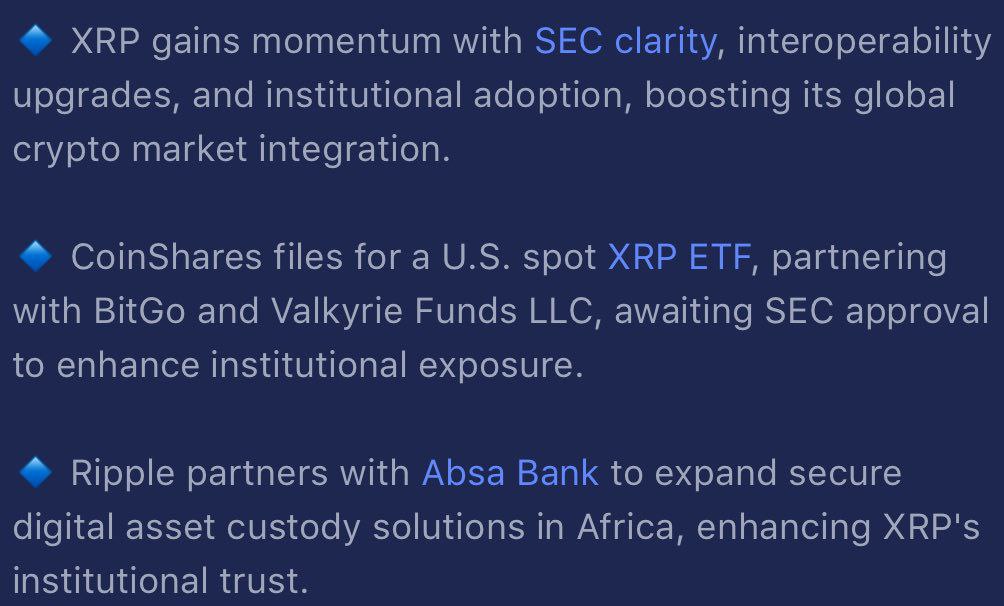

The future of XRP adoption is better than it has ever been in years. The protracted legal battle with the US SEC is coming to an end, which provides institutions with the regulatory transparency they require. This development instantly paved the way for some of the financial giants to submit an application to a spot XRP Exchange Traded Fund (ETF).

To give one example, companies such as CoinShares are propagating this trend. This institutional enthusiasm is evident: XRP funds have just obtained a huge inflow of $219.4 million in a week. Besides, Ripple is feverishly broadening its presence on an international level. Recently, it has launched a large custody alliance with Absa Bank in South Africa. This partnership is being implemented in some of the African economies such as South Africa, Kenya and Mauritius.

The aim is to offer safe and regulatory custody of digital assets, which is a key issue to investors. Such a strategic step corresponds with the demands of the region, since the latest report revealed that 64% of Middle Eastern and African leaders in the field of finance are more preoccupied with the accelerated time of settlement that a blockchain provides. In the end, such measures increase the level of trust in digital assets and make XRP the leader of the new financial system.