Yield farming is one of the hottest trends in decentralized finance (DeFi), and chances are you’ve already heard about the impressive returns that many yield farmers are earning through this innovative strategy.

Unlike simply holding your crypto, trading tokens, or investing in NFTs, yield farming offers a more dynamic way to grow your digital assets.

It involves lending or staking cryptocurrency on DeFi platforms to earn rewards, often at rates much higher than traditional finance.

For example, by lending assets such as Ethereum, Basic Attention Token, or stablecoins, you could earn interest ranging from 9% to 50%, depending on the platform and market conditions.

In comparison, most high-yield savings accounts only offer around 1.9% interest, making yield farming an attractive option for crypto investors seeking better returns.

If you’re curious to learn more, keep reading. We’ll cover what yield farming is, how it works, and the essential factors you should know before diving in.

What is Yield Farming?

Yield farming is also called liquidity mining. The term “yield farming” contains two words: “yield” and “farming.”. The term “yield” is a financial term that means what you give for investing, farming and represents the possible expansion growth you can receive.

Simply put, yield farming means’ locking cryptocurrency and taking rewards on a decentralized ecosystem. But it’s hard to define yield farming because it looks like staking and liquidity pools.

At its core, yield farming relies on smart contracts that create “liquidity pools.” These liquidity pools accept deposits from users, which are then lent out or used in various DeFi protocols in exchange for transaction fees and rewards. By participating in these pools, investors can earn interest and other incentives, often at rates far higher than traditional financial products. Find more about it.

How Does Yield Farming Work?

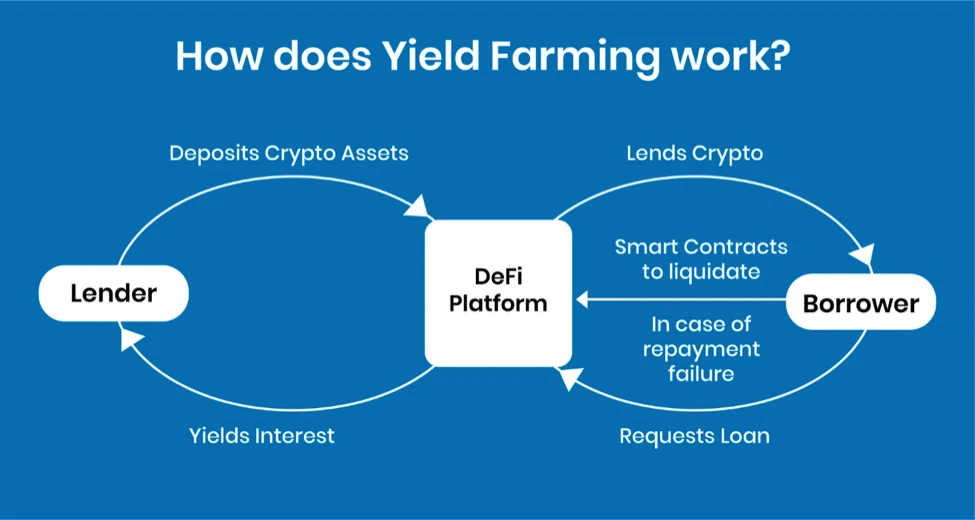

Most yield farming strategies take place on decentralized exchanges, which use smart contracts and automated market makers (AMMs) to manage funds from liquidity pools.

A liquidity pool is essentially a digital marketplace where users can trade, lend, and borrow tokens without relying on intermediaries. These pools are funded by liquidity providers (LPs), crypto investors who deposit their assets to keep the ecosystem running.

To participate, liquidity providers typically deposit two tokens in a 50/50 ratio, often pairing cryptocurrencies like ETH, BNB, or stablecoins. In return, they earn rewards in the form of transaction fees and additional incentives distributed based on their share of the pool.

This system is powered entirely by smart contracts, which automate transactions and ensure transparency. These contracts form the backbone of yield farming, allowing users to generate passive income while contributing to decentralized finance liquidity.

How to Earn Through Yield Farming?

There are several ways to generate income through yield farming, and each method comes with unique strategies and risk levels. In every approach, two key factors, the type of assets you provide and the transaction volume, play a major role in determining your overall returns.

Below are three of the most popular yield farming methods used by crypto investors to maximize rewards:

Liquidity Providers

Liquidity providers are an important part of the decentralized financial markets. They provide a necessary service by supplying liquidity to the markets.

This liquidity is used by investors to make trades and by traders to enter and exit positions from the liquidity pool.

Let’s break down how profits in yield farming work with a simple example.

Imagine you deposit $1,000 worth of ETH and $1,000 worth of BAT (a total of $2,000) into a liquidity pool, giving you 1% ownership of the pool. The next day, users trade $2 million worth of ETH and BAT in that pool. With a 0.5% trading fee, the pool collects $10,000 in fees.

Since your share of the pool is 1%, you would earn $100 in a single day based on your initial $2,000 investment. These earnings come directly from trading fees paid by users swapping tokens through your liquidity.

How much you will earn from yield farming depends on how much liquidity you provide in the pool. Trading fees and trading value will affect earnings.

This is why research is essential before investing in yield farming. Platforms like Uniswap and other Ethereum-based DeFi protocols are popular among liquidity providers because they often offer higher fee percentages and strong market activity, increasing the potential for returns.

Crypto Lending

“Crypto lending” is a term used to refer to lending cryptocurrencies for interest. This way, you can get more crypto in return by lending your assets to borrowers for a certain time.

This type of activity is very common in the financial markets, but it’s also available on a smaller scale to users who want to lend their cryptocurrencies and get more in return.

The main difference between lending crypto and fiat is the fact that the latter is backed by governments, while the cryptocurrency is backed by a smart contract.

For example, you can lend Ethereum and earn interest. You can also do this with stablecoins such as Tether (USDT), Binance Coin (BNB), and True USD (TUSD) and earn interest from them.

Crypto lending is considered easy and secure for yield farming because it is also available on centralized exchanges, which are recognized by some governments.

There are many platforms that offer higher returns than banks. Some centralized platforms, like Binance, Coinbase, Crypto.com, and Gate, and some decentralized platforms, like UniSwap and PancackSwap, offer crypto lending services.

Find the ten best crypto lending platforms.

Crypto Staking

Proof-of-stake (PoS) is an alternative to the proof-of-work (PoW) system, and this trait attracts lots of users involved in yield farming.

Do not get confused between crypto staking and crypto lending. Both are different, with some common.

Crypto staking means leasing your crypto to the blockchain, while crypto lending means leasing your crypto to the borrower for a specific time on the platforms. In return, you get rewarded with new coins or tokens.

You can also collect transaction fees paid by other users on the network.

Staking works similarly to mining, but it doesn’t require expensive hardware and software solutions.

The staking process involves locking your crypto assets into a specific wallet or protocol that validates transactions on the blockchain and secures the network.

The more cryptos you stake, the more rewards you get.

Find the ten best crypto staking platforms.

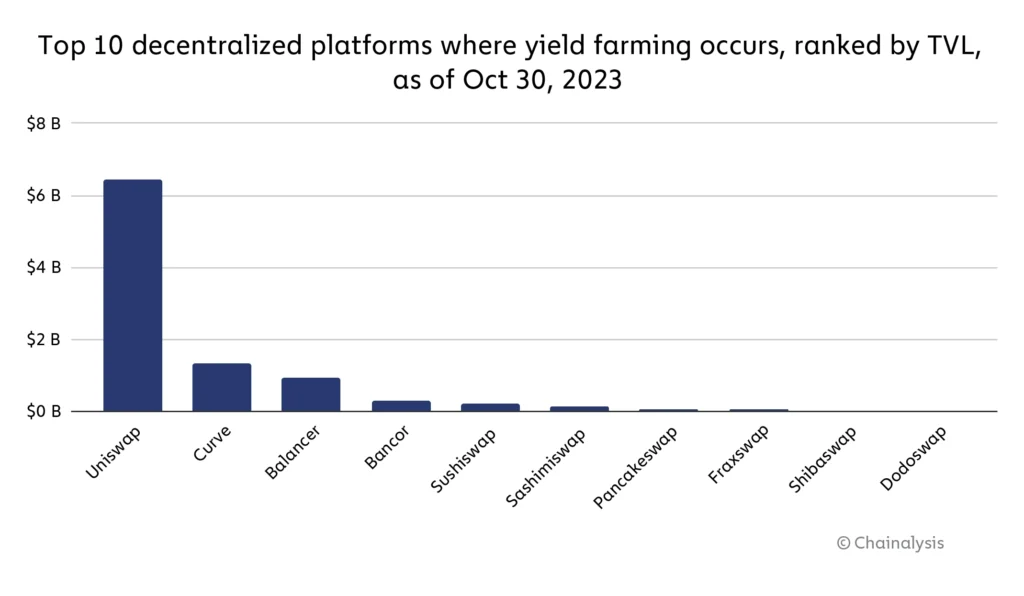

What are the Best Yield Farming Platforms?

When it comes to yield farming, you have two main types of platforms to choose from:

Centralized platforms, like Binance or Coinbase, are great for beginners. They often offer lending and staking options that are simpler to use and come with lower risks. These platforms handle much of the technical complexity for you.

Decentralized platforms, like Uniswap, Aave, and PancakeSwap, provide higher earning potential but require a better understanding of how liquidity pools, smart contracts, and automated market makers (AMMs) work. By becoming a liquidity provider on a DEX, you can earn more in trading fees and rewards, making it a popular choice among experienced yield farmers.

For maximum returns, many investors prefer the Ethereum network due to its robust DeFi ecosystem, while Solana is ideal for those looking for faster transactions and lower fees.

Compound Finance

An Ethereum-based open marketplace that allows its users to borrow and lend crypto assets. Anyone with an Ethereum wallet can participate in a pool and earn rewards, which are adjusted algorithmically based on supply and demand.

The compound has 18 markets, and rewards are distributed in compound tokens. For supply, it gives a 0.05% to 8.46% reward, while borrowing interest is 0.34% to 19.53%.

Nexo

Nexo is a centralized platform for crypto lending and borrowing. It has almost every feature that a beginner needs to start yield farming.

With Nexo, you can put your idle assets to work right away and have a predictable source of passive income without the risk.

It supports 32 cryptos, including BTC and ETH, with a 6% to 34% interest rate. The rate will increase by 2% if you claim your reward in NEXO coins.

Aave

A decentralized platform for lending and borrowing, which is heavily used for yield farming. The reward varies from coin to coin and is paid in Aave tokens.

The deposit rate ranges between 0.01 and 12.77%, and borrowing is below 35.61%.

Uniswap

A leading decentralized exchange platform that supports ERC20 tokens. UniSwap has two versions, V2 and V3, that are heaven for yield farming via liquidity providers.

To participate in the pool, users have to provide a 50-50 ratio in a certain cryptocurrency to earn rewards, which are paid in UNI tokens.

The V3 version has 672 markets, while the V2 version has 1758 markets.

PancakeSwap

This one is following the same path as UniSwap, but it works on the Binance Smart Chain network (BSC) to support BEP20 tokens.

Pancake offers many features, like gamification with the lottery, team battles, and NFT collectibles, which make it more attractive for yield farming.

SushiSwap

It is a fork of UniSwap. On it, you can swap, earn, stack yields, lend, borrow, and leverage all on one decentralized, community-driven platform. Its native token is SUSHI.

Benefits of Yield Farming

- Yield farming is all about earning as much profit as possible.

- The profits are earned by providing liquidity to decentralized exchanges and staking tokens in different protocols.

- By providing liquidity, you receive a share of the transaction fees.

- Entering a Yield Farming project early often means higher returns, as rewards can be more generous at the start of a protocol’s growth phase.

- By staking, you’re able to earn the protocol’s native token, which can be traded for other digital currencies on cryptocurrency exchanges.

- Many experienced yield farmers use their digital assets as collateral for loans, allowing them to reinvest borrowed capital and increase their returns.

- It offers higher returns than these traditional methods thanks to its ability to compound earnings over time through compounding interest rates—meaning that if you reinvest your earnings into the same investment, you’ll get even more returns.

Risks of Yield Farming?

- Yield farming can be quite risky because it involves moving cryptos from one platform to another, and many of these platforms have been hacked before. This means that there’s always a risk of losing your cryptos if you’re not careful with who you choose.

- One of the most important things you need to understand about yield farming is that the most profitable strategies are highly complex. They may also require you to hold large amounts of capital in order to take advantage of them, so if you are new to crypto or don’t have much liquidity available, then yield farming may not be right for you.

- Also, yield farming isn’t something that can be done easily and without risk. If you don’t understand what you’re doing or aren’t careful with your investments, then you might lose money.

- One obvious risk of yield farming is smart contracts. If there’s a bug in the code, your funds can be stolen or sent to the wrong address.

- The failure of Defi products is also a great threat to yield farming. We have witnessed Maker DAO’s failure in 2020.

- Any type of cryptocurrency can be used for yield farming, but not all cryptocurrencies.

- A Defi product can be accessed only with a non-custodial wallet, so if you lose your wallet, you can never access your funds from Defi.

- Getting constant returns is hard because other users throw high volumes of money at holding a higher position.

- Every Defi protocol gives a reward in their native token, and many investors think it could be risky because the circulation supply of tokens is increasing day by day, and eventually the price can go to zero.

Conclusion

Yield farming is generally more suited to those who have a lot of capital to deploy. If you don’t understand what you’re doing or don’t have enough money on hand to buy into a protocol and get liquidity going, you’ll likely lose money.

Choosing the right pair also determines how much you will earn.

The more popular pair you choose, the more money you need to hold the position. So make your own wise decisions and do your own research before putting money into yield farming.

Here find out how you can earn crypto with arbitrage trading.