What is Blockfi?

BlockFi is a financial management platform for cryptocurrency holders that allows them to do more with their digital or cryptocurrency assets, like providing interest and loans. The company services clients worldwide, including 48 U.S. states, with interest-earning accounts and low-cost USD loans backed by crypto.

BlockFi is the only independent lender with institutional backing from investors that include Galaxy Digital, Susquehanna, Akuna Capital, Fidelity, Recruit Strategic Partners, ConsenSys Ventures, SoFi, Coinbase Ventures, CMT Digital, and Morgan Creek Digital.

Company address.

201 Montgomery Street

Second Floor, Suite 263

Jersey City, New Jersey, 07302

646-779-9688

What is BlockFi Interest Accounts (BIA)?

BIA is an interest-bearing or crypto-storing account that provides the ability for its users and crypto investors to store their crypto at Blockfi. And receive, or get paid, interest every month in cryptocurrency without selling your cryptos.

In simple words, it works like your bank account deposits money and takes interest every month.

What are Blockfi’s main features?

In the present, Blockfi offers three fundamental features, which are.

- Cryptos Loan.

- Trading Cryptos.

- Blockfi Interest Account (BIA).

How do I apply for a BlockFi account?

Go to the Blockfi website to create an account and complete ID verification. Blockfi is available in all countries, but there are some exceptions. For example, because of legal restrictions, Blockfi Interest Accounts are available in the U.S. but not in New York.

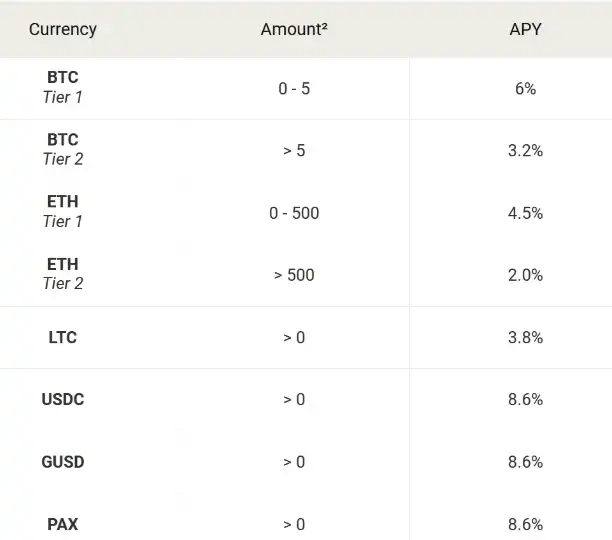

What are the rates?

The rates of BIA are different for different coins. See the annual percentage yield (APY) of all coins. You will see Tier 1 and 2, which means that for Tier 1 between 0 and 5 Bitcoins, you will earn 6% APY (The interest rate is subject to change)

How much can you earn?

It totally depends on how much you have invested. Like Blockfi said, you can earn up to 8.6% APY on your cryptocurrency. For example, if you invest 10,00 USD or stable coins into a Blockfi Interest Account, you may earn up to $86. And with this amount, you can withdraw it monthly or annually as you want.

How do I withdraw funds?

- Follow the steps to withdraw funds.

- Go to Blockfi and login to your account.

- Go to the dashboard and click on the interest account option.

- Select the asset or coins you want to withdraw.

- Click on the “Withdraw” button.

- Enter the amount you want to withdraw and the wallet address for the return.

- Your withdrawal will take about 24 hours for security.

- Be alert during the withdrawal process; otherwise, BlockFi will not

- responsible for any typos or mistakes made in entering information.

BlockFi Withdrawal Limits.

Blochfi has graceful withdrawal limits for all users, and users can withdraw a tremendous amount of earned coins. So there is no risk of money stuck for low withdrawal limits. In the Bitcoin case, users can withdraw 100 BTC per week at the respective fee rates (one-time free withdrawal per month).

BlockFi Interest Account withdrawal fees?

Blockfi offers one-time free withdrawal per user per month; after that, Blockfi charges little fees for withdrawals from its users. The fees are 0.0025 BTC or 0.0015 ETH on any amount.

On which coin can you earn interest?

Currently, to earn interest, Blockfi Interest Account supports 7 coins, which are Bitcoin, Ethereum, Litecoin, GUSD, PAX, USDC, and USD as well.

Minimums and maximums for the BIA.

There is no minimum or maximum deposit for the BlockFi Interest Account. But if you deposit a much more moderate amount, it will take 30 days to proceed. To learn more about BlockFi rates and interest tiers, visit the rates page.

Are there risks associated with BIA?

BlockFi client funds are structured to be at the top of the capital stack, senior to BlockFi equity, and BlockFi employee capital. This means BlockFi’s business and client incentives are aligned and BlockFi would take a loss before any client would. BlockFi implements very thoughtfully risk management practices and technology to mitigate the risk, but you should not view the BlockFi Interest Account as a savings account or brokerage account with FDIC or SIPC insurance.

BlockFi Loans.

This is another important feature of Blockfi that allows you to take the loan in USD, GUSD, or USDC from your crypto assets, selling no amount of crypto.

How can I get a loan?

- Create an account at Blockfi.

- Click on the Loan tab.

- Click Apply and fill out the application.

- You will receive a decision from our team in less than 24 hours.

- Review your loan offer and sign the loan agreement.

- Transfer collateral to BlockFi’s secure storage wallet.

- Receive your loan the same day in USD via wire to your bank account or stable coin to your wallet address of choice.

- Make interest-only payments monthly using USD, BTC, ETH or LTC

- Pay off the principal in one payment at the end of the term, or refinance at current rates.

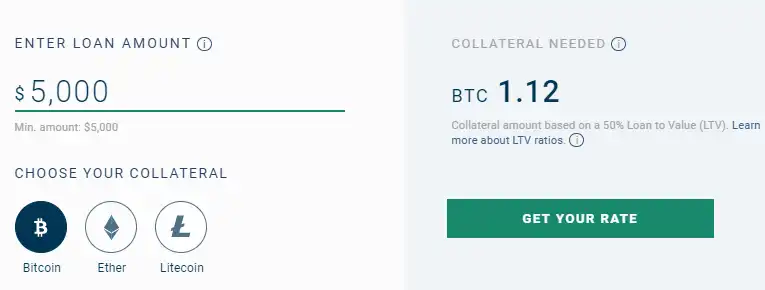

What are the loan rates?

The loan value on Blockfi is 50%, which means that by using your crypto as collateral, you can unlock up to 50% of the value of your assets in USD. They fund the same day through the wire or stable coin. BlockFi’s interest rates vary based on several variables, including location, loan size, collateral type, and LTV.

As you can see, if you want to apply for a $5,000 loan, you have to deposit 1.12 bitcoins (the collateral needed is subject to change). To calculate your loan, click here.