Buying Bitcoin with a bank card has become one of the most popular and convenient methods worldwide. However, not every exchange or platform allow you to buy bitcoin with bank card.

Today, this problem is largely solved. Many trusted platforms now allow users to quickly and securely buy bitcoin with a bank card, whether it’s a debit or credit card. These services have been established for years and are known for their reliability, speed, and user-friendly experience.

In this guide, I’ll highlight the best platforms where you can instantly buy bitcoin with bank card and explain what makes them stand out. Whether you’re using Visa or Mastercard, these exchanges make the process simple and accessible for beginners and experienced traders alike.

So, let’s dive straight in and explore the top choices to buy bitcoin with bank card today.

If you want to buy bitcoin with a bank card instantly, then you will need the following things:

- Wallet: To store your coins in a safe place.

- Bank card: A debit or credit card for transferring money.

- An exchange platform: in case you want to convert your coin into another, it is not required if you have chosen a multi-crypto wallet.

- ID card: For completing KYC, it may vary according to the platform, but mostly it is a passport, driving license, or national card.

Six Platforms to Buy Bitcoin with Bank Cards

If you already know how to buy Bitcoin with a bank card, chances are you’re excited to get started. But before making a choice, it’s important to understand how the different platforms vary. Some exchanges focus on lower fees, while others prioritize speed, global access, or user-friendly interfaces.

Coinbase

Coinbase is one of the largest and most trusted cryptocurrency platforms, widely known for its user-friendly wallet and simple interface. The minimum purchase starts at just $25 worth of Bitcoin when using a bank card. As you complete higher levels of verification, your purchase limits increase.

Since Coinbase requires full KYC (Know Your Customer) verification, you’ll need to provide your identity details before buying Bitcoin with any payment method, including a bank card.

When it comes to fees, Coinbase is slightly higher than some competitors, especially if you choose to buy Bitcoin with bank card. The platform charges around 3.99%, though the exact fee depends on your country and whether you’re using a debit or credit card. The rate is fairly standard worldwide but always double-check before making a purchase.

Before you proceed to buy Bitcoin on Coinbase, make sure the platform supports transactions in your country, as availability can vary.

Supporting countries to buy bitcoin with bank card.

Mexico, US, Chili, Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Gibraltar, Greece, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Italy, Jersey, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom, Singapore,

Pros

- Beginner-friendly interface and wallet integration

- High trust and global reputation

- Fast purchases with debit or credit cards

- Secure platform with regulatory compliance

- Mobile app for easy access

Cons

- Higher fees (around 3.99%) compared to other exchanges

- Requires full KYC verification

- Not available in all countries

- Limited advanced trading features compared to pro exchanges

CoinMama

Operating across more than 188 countries, Coinmama allows you to purchase a variety of cryptocurrencies using both credit and debit cards. Supported coins include Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Cardano, Litecoin, Qtum, Ripple (XRP), Tezos, and EOS.

Payments can be made in several major fiat currencies, such as USD, EUR, GBP, AUD, JPY, and CAD. While you can buy in your local currency, keep in mind that your bank may apply an additional exchange fee if you pay in a different currency.

If you are using Visa or Mastercard, Coinmama enables you to buy bitcoin with a bank card instantly after completing verification. Purchase limits depend on your account level:

Level 1 users can buy up to $5,000 per day with a credit card. Higher levels unlock larger limits, which require completing additional KYC verification.

Not supporting countries on Coinmama.

Cuba, Crimea, Iran, Israel, Lebanon, North Korea, the Palestinian Territories, South Sudan, and Syria.

Prons

- Available in 188+ countries worldwide

- Supports multiple cryptocurrencies, not just Bitcoin

- Fast transactions with Visa and Mastercard

- Simple verification process to increase purchase limits

- Accepts several major fiat currencies

Cons

- Fees are higher compared to some global exchanges

- Requires KYC verification for all purchases

- Does not offer a built-in crypto wallet (coins must be sent to an external wallet)

- No advanced trading tools, mainly a buy/sell platform

Bitpanda

Most trusted platforms in Europe to buy bitcoin with bank card. Based in Austria, Bitpanda has built a strong reputation for its user-friendly interface and reliable services. Once verified, you can access all of Bitpanda’s features without tier-based restrictions, meaning every user enjoys the same limits and functionality.

To buy bitcoin with bank cards on Bitpanda, you must verify at least your email and mobile number. With this basic verification, you can buy and sell up to €50 worth of Bitcoin instantly. Higher purchase amounts require completing full KYC verification.

When it comes to fees, Bitpanda does not list them directly on its website. Instead, fees are included in the price and displayed during the buying or selling process. On average, the fee for card purchases is estimated to be around 5%, which is slightly higher than some other exchanges.

Prons

- Simple verification process for small purchases

- No tier restrictions; all verified users access the same features

- User-friendly platform, great for beginners

- Supports multiple payment methods beyond bank cards

Cons

- Fees can be relatively high (around 5%)

- Limited purchase amount (€50) without full KYC verification

- Primarily focused on European users, less accessible worldwide

- Lack of fee transparency on the main website

- Available only for the European region.

Bitcoin.com

If you’re looking to start small, Bitcoin.com is an excellent choice to buy bitcoin with bank card. The platform allows purchases starting from as little as $20, making it beginner friendly.

Bitcoin.com supports worldwide purchases with both credit and debit cards. In addition to Bitcoin, you can also buy other popular cryptocurrencies such as Bitcoin Cash, Ethereum, Litecoin, Stellar, Ripple (XRP), and more.

Unlike many exchanges, Bitcoin.com does not require you to create an account before purchasing. Simply enter your details, select the amount, and you can instantly buy bitcoin with bank cards.

Prons

- Supports worldwide transactions with debit and credit cards

- No mandatory account creation for small purchases

- Wide selection of supported cryptocurrencies

- Simple, beginner-friendly process

Cons

- Fees are higher compared to traditional exchanges

- Limited advanced features for traders

- Lack of transparency on fee breakdown until checkout

- Less suitable for large-volume buyers due to limits and higher costs

- Only USD and EUR are available for exchange

Lumi Wallet

It’s an anonymous, non-custodial wallet available on multiple devices, allowing users to purchase and manage cryptocurrencies without providing personal details.

With Lumi Wallet, you can instantly buy BTC, ETH, USDT, and more using a bank card. The platform supports over 1,200 coins and tokens for exchange (though only selected assets are available for direct purchase).

You can buy up to $150 worth of Bitcoin, Ethereum, or USDT with bank card without any verification, making it ideal for users who prioritize anonymity and convenience.

Lumi Wattle supports almost every country that buys bitcoin with bank cards. But like other platforms, due to countries’ privacy and policies, it has also restricted some countries that follow. If you are from the United States, it does not support the following states:

- Georgia (GA),

- New Mexico (NM),

- Hawaii (HI),

- Washington (WA),

- Oregon (OR),

- Vermont (VT),

- Florida (FL),

- Alabama (AL).

Prons

- Anonymous wallet — no KYC required for small purchases

- Supports 1,200+ coins and tokens for swapping and trading

- Easy to use on any device (mobile or desktop)

- Non-custodial wallet, meaning you control your private keys

- Quick purchases up to $150 with a bank card

Cons

- Restrictions in some of the USA states.

- Govern by Changelly exchange.

- Limited purchase amount without verification ($150).

- Higher fees compared to centralized exchanges.

- Lack of advanced trading features.

- Sometimes it takes a long time for the coin to appear in the wallet.

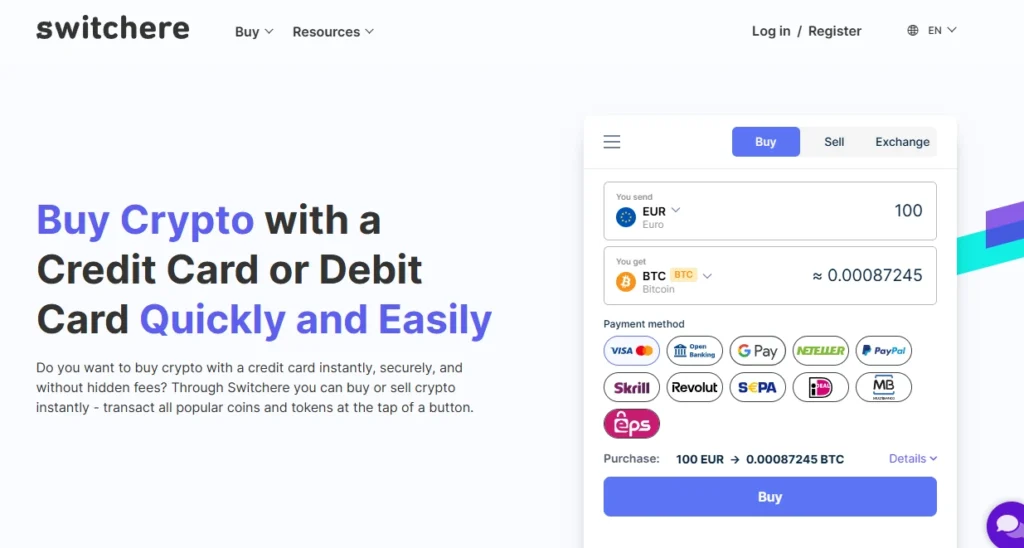

SwitcHere

Switchere is one of the fastest-growing crypto platforms that allows users to buy bitcoin with bank card instantly in almost every country. In addition to card payments, it also supports local bank transfers, making it highly convenient for users across different regions.

Using Switchere exchange features, users can buy BTC, BHC, ETH, DASH, EOS, LTC, XML, XRP, and USDT20 in a few clicks with their credit card (USD, EUR) and the local bank (MYR, IDR, THV, VND).

The minimum daily amount of transactions is $4,800 (€4,350) in the case of buying with credit card, but you can increase the amount by completing verification.

Switchere does not show fees on its website, but you can see and calculate the fees during the last transaction. It may be between 5 and 15% of the amount.

If you are from Indonesia, Malasia, Thailand, or Vietnam, then you can buy bitcoin with a bank account in your local currency.

Prons

- Available almost worldwide, with support for local bank payments

- Wide selection of cryptocurrencies (BTC, ETH, XRP, LTC, etc.)

- User-friendly platform with instant transactions

- Local currency support in Southeast Asia (MYR, IDR, THB, VND)

- High daily limits with verification

Cons

- High fees (5%–15%), less competitive than major exchanges

- Limited transparency on fee structure before checkout

- Requires verification for higher purchase amounts

- Not ideal for professional traders, as it lacks advanced tools

Conclusion

Whether you value privacy, speed, or ease of use, there’s a platform that fits your needs. From major exchanges like Coinbase and Coinmama to regional leaders like Bitpanda or anonymous wallets like Lumi.

While most platforms require KYC verification to ensure compliance and security, some alternatives like P2P offer a more private way to buy bitcoin with bank cards without ID. This peer-to-peer approach provides flexibility, but users must take extra care to choose trusted sellers.

The biggest disadvantage of purchasing Bitcoin with a bank card is the strict verification process and slightly higher fees compared to bank transfers or other methods. Despite these challenges, the speed, accessibility, and global availability make buying Bitcoin with bank card a preferred choice for millions of users worldwide.