There are many ways to trade cryptocurrencies, but if you’re looking for a fast and straightforward way to trade crypto, then crypto arbitrage trading is a strategy worth exploring.

As a crypto trader, you’re already familiar with the various crypto exchanges used for buying and selling digital assets. However, there’s a growing trading method that’s helping traders around the world maximize profits with minimal risk.

This strategy is called crypto arbitrage. It has quickly become one of the most popular approaches in the cryptocurrency market because it allows traders to take advantage of price differences between exchanges.

By spotting and capitalizing on these price gaps, traders can earn consistent returns without relying solely on market speculation.

In simple terms, crypto arbitrage trading is a modern and efficient way to grow your cryptocurrency holdings.

If you’re wondering, “What exactly is crypto arbitrage, and how can I make money with it?” this guide will walk you through everything you need to know.

What is Crypto Arbitrage Trading?

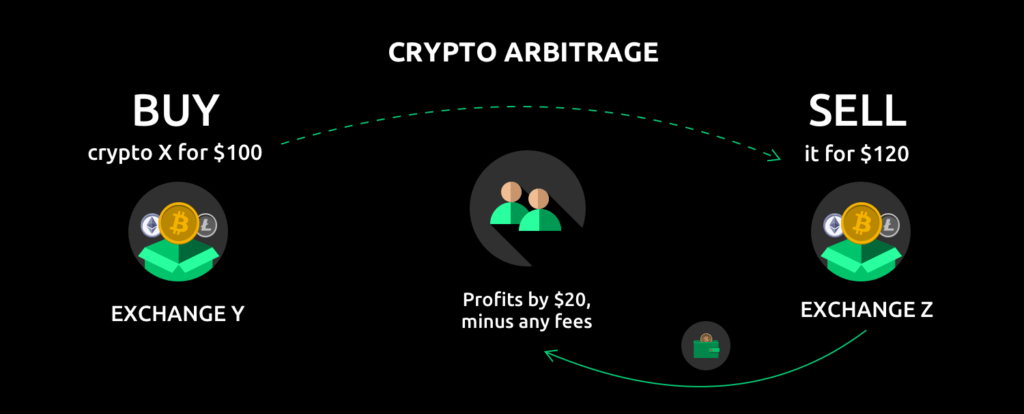

Crypto arbitrage is the practice of buying and selling cryptocurrencies on different exchanges to take advantage of price differences. These variations in buy and sell prices across platforms are known as price gaps or arbitrage opportunities.

When these price gaps occur, traders can make an instant profit by purchasing a cryptocurrency at a lower price on one exchange and selling it for a higher price on another.

The main goal of crypto arbitrage trading is to earn a steady income with minimal risk and effort, making it an attractive strategy for both beginner and experienced traders. Read More.

Why Are Prices Different Across Crypto Exchanges?

Crypto arbitrage opportunities exist because cryptocurrency prices often vary between different exchanges.

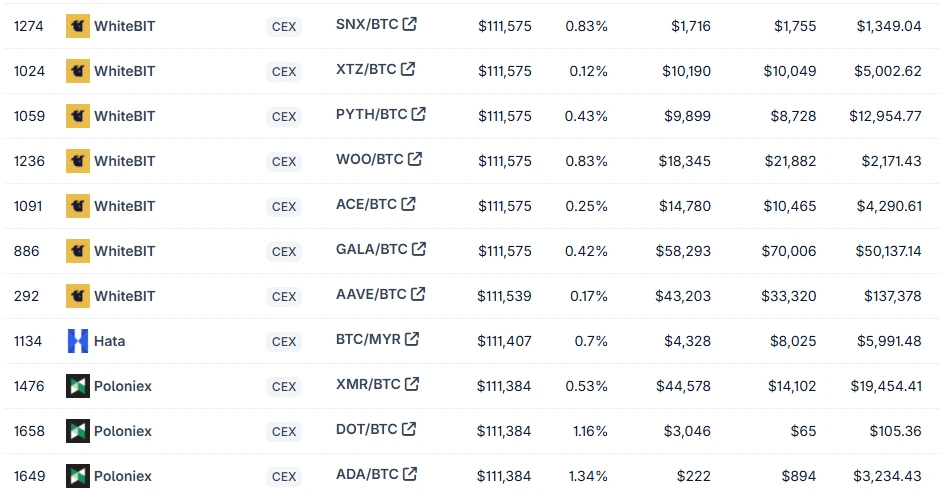

If you visit platforms like CoinMarketCap, you’ll notice that the same crypto asset may have different prices on various exchanges. This happens due to differences in trading volume, liquidity, and the way exchanges determine prices.

Even though exchanges constantly monitor competitors’ prices to stay competitive, these discrepancies still occur, and savvy traders use crypto arbitrage trading to profit from them.

Price Formation on Centralized Exchanges (CEX)

On a centralized exchange (CEX), prices are determined by the order book system. The limit orders placed by buyers and sellers can create significant price gaps.

For example, if Bitcoin’s market price is $98,928 but a trader sets a buy order at $99,000 and it gets filled, $99,000 becomes the new real-time price on that exchange.

This system can lead to noticeable price differences across centralized platforms, which fuels crypto arbitrage opportunities.

Price Formation on Decentralized Exchanges (DEX)

On a decentralized exchange (DEX), pricing works differently. DEXs often use Automated Market Makers (AMMs) or smart contract-based liquidity pools instead of a traditional order book.

Each liquidity pool is funded by users, and token prices are determined by a mathematical formula that balances supply and demand.

For example, if a trader buys ETH from an ETH/USDT pool, they must add USDT to the pool to remove ETH. To maintain balance, the AMM automatically increases ETH’s price and decreases USDT’s price.

This automated pricing model keeps markets efficient but can also lead to temporary price discrepancies, creating crypto arbitrage opportunities.

Types of Crypto Arbitrage Trading

There are several ways traders can profit from crypto arbitrage by leveraging price gaps across exchanges or markets. Below are the most common types:

Statistical Arbitrage (Easy)

Statistical arbitrage uses advanced mathematical models and algorithms to identify price discrepancies. This method is almost entirely automated and is executed using trading bots, making it faster and more precise than manual trading.

Cross-Exchange Arbitrage (Easy)

The simplest form of crypto arbitrage, this strategy involves buying a cryptocurrency on one exchange where it’s priced lower and selling it on another exchange where it’s priced higher. It’s ideal for beginners because it’s easy to execute and understand.

Spatial Arbitrage (Medium)

Also known as geographical arbitrage, this method exploits price differences between exchanges in different regions. These differences often arise due to local demand, supply, and trading regulations. Traders use this to buy crypto in one region and sell in another at a higher price.

Triangular Arbitrage (Medium)

This advanced method occurs within a single exchange. It involves three different trading pairs to create a loop that starts and ends with the same cryptocurrency.

Example: Trading BTC → USDT → ETH → BTC to capture small pricing inefficiencies.

Decentralized Arbitrage (Hard)

In decentralized exchanges (DEXs), prices are determined by liquidity pools rather than order books. DEX arbitrage involves exploiting situations where a token’s price is undervalued or overvalued compared to centralized exchanges or other DEXs.

Time Arbitrage (Hard)

This strategy takes advantage of price update delays between exchanges. Traders buy an asset in a market where prices update slowly and quickly sell it on another market with real-time pricing, profiting from the delay.

How Does Crypto Arbitrage Trading Work?

Crypto arbitrage is a trading strategy that capitalizes on price differences between exchanges. It involves buying and selling the same cryptocurrency simultaneously on different platforms to profit from the price gap.

In the world of cryptocurrency, these opportunities arise when a coin’s price on one exchange is significantly lower or higher than on another. Traders take advantage of this difference to earn quick profits with minimal market risk.

For example,

Imagine a trader purchases 1 BTC on KuCoin for $100,000 and immediately sells it on Binance for $100,120. This simple transaction nets the trader a $120 profit.

The process can be repeated multiple times, as long as price discrepancies exist. Many professional traders use arbitrage bots to scan markets and execute these trades instantly, ensuring they don’t miss opportunities.

How to Find a Crypto Arbitrage Trading Opportunity?

To spot a profitable crypto arbitrage opportunity, start by identifying exchanges with the largest price disparities for a specific cryptocurrency (e.g., Bitcoin, ETH, XRP).

Tools like CryptoCompare, CoinMarketCap, and CoinGecko make this process simple.

Once you’ve found a price difference, choose exchanges with low trading fees and high liquidity. High trading volume ensures you can buy and sell assets quickly without significantly affecting the market price.

On CoinMarketCap or CoinGecko, click on the cryptocurrency you want to trade and go to the “Markets” section. There, you’ll see a list of all exchanges and their current prices.

Sort the list from lowest to highest to identify the best trading opportunities.

Whenever possible, trade using USDT pairs, as nearly all exchanges support them. This simplifies transactions, especially if you’re working across multiple platforms.

For decentralized exchanges (DEXs), you may need to manage trades through liquidity pools instead of traditional order books.

How to Start Crypto Arbitrage Trading?

Cryptocurrency arbitrage is a great way to make quick trades with almost no risk.

However, for those looking to make money on crypto, crypto arbitrage trading is not so simple. It’s possible that you could lose money if you don’t know what you’re doing.

You can do crypto arbitrage in two ways. That is.

1. Manual Trading

With manual trading, you do everything yourself.

- Create accounts on at least two different exchanges.

- Find a cryptocurrency (for example, BTC) that is cheaper on one exchange than another.

- Buy it at the lower price, transfer it to the exchange where it’s more expensive, and sell it for a profit.

This method gives you full control but is time-consuming and can be affected by transaction fees and transfer delays.

2. Trading Bots

Because of fast price movements, many traders use crypto arbitrage bots. Bots automatically:

- Scan exchanges for price differences.

- Execute trades instantly.

- Remove the need for manual transfers.

The downside is that trading bots require technical setup and often come with subscription costs for advanced features. Still, they’re ideal for traders who want speed and efficiency.

Find out how to earn crypto with yield farming.

Advantages of Crypto Arbitrage Trading

Crypto arbitrage trading offers several benefits that make it attractive to both beginners and experienced traders:

- At its core, crypto arbitrage is straightforward: buy cryptocurrency at a lower price on one exchange and sell it at a higher price on another.

- Unlike long-term investments, arbitrage allows traders to make profits in a short period without waiting years for price appreciation.

- Arbitrage focuses on price differences rather than market speculation, making it a lower-risk strategy. There’s also less exposure to scams like Ponzi schemes or pump-and-dump tactics.

- You don’t need deep market analysis experience to get started. Even beginners can take advantage of basic price discrepancies.

- Crypto markets are highly volatile, which means frequent price fluctuations—perfect for arbitrage traders seeking consistent opportunities.

Disadvantages of Crypto Arbitrage Trading

Crypto arbitrage is a lucrative business for many investors. However, it does have some risks and disadvantages attached to it too.

- You have to create and manage multiple accounts, which consumes time, and KYC is annoying as well.

- For arbitrage trading, you have to transfer crypto quickly in order to take advantage of the price. While performing this step, any mistake (especially entering the address) can cause a permanent loss of money.

- Low volume is another problem of crypto arbitrage, which means you will face problems executing a large amount of trade.

- Transaction cost is one of the huge barriers between exchanges, giving the best arbitrage. Your profit will be negligible if you do not focus on transaction costs.

- After the transaction cost, the buying fee also plays a major role in your arbitrage profit. Here, the third party involves buying crypto with fiat, and they charge a huge percentage of the fee. Currently, “Legendary Trading” is considered the cheapest third party to buy crypto, which charges 0.08% per transaction, but sadly, it does not support every exchange.

- The slower transaction is another halt to crypto arbitrage trading, and you can do nothing about that. Bitcoin transactions take much longer to be processed when compared to Ethereum (ETH) transactions.

- It happens rarely. If your country has no proper rules and regulations about crypto, then they might have a chance to impose a money laundering case on you because you are transferring money overseas.

Key Tips for Successful Crypto Arbitrage Trading

To maximize profits and reduce risks when engaging in crypto arbitrage trading, follow these essential tips:

- Avoid third parties, such as Master or Visa cards or Wire, that charge a huge fee to buy crypto. Currently, Legend Trading is only charging a 0.08% fee.

- Do not trade with a small amount; otherwise, you won’t get better results. Instead, aim to make 2–5 percent profit according to the amount in one transaction.

- To reduce transaction fees, avoid ERC20 tokens or any coin that affects your profit. And also keep an eye on the maker and taker fees on the exchange.

- If possible, target new listing coins because of low demand; the price could be lower than on other exchanges.

- You have to log in several times to enable all features and ensure strong security to avoid any risk or hack threat.

- To avoid money loss, set limit loss features.

- Timing plays an important role in crypto arbitrage, so make sure all processes are done quickly.

Conclusion.

Trading different types of digital assets like Bitcoin, Litecoin, and Ethereum can be a great way to make profits. The best part is that the potential risk involved is very low when compared to traditional forms of trading.

This makes crypto arbitrage a great option for traders who have little to no experience in the world of cryptocurrency trading.