There is a high level of rivalry in the digital asset market, especially in the AI industry. With this commotion, the KGEN token is creating a solid argument on the available financial performance and community involvement. Examining the metrics underlying KGEN and going beyond the hypothetical hype, one can understand why this company might be underestimated greatly. Thus, the investors ought to be concentrated on facts and growth rates that make this project conspicuous. This in-depth analysis gives an important insight on the attractive future opportunities of KGEN.

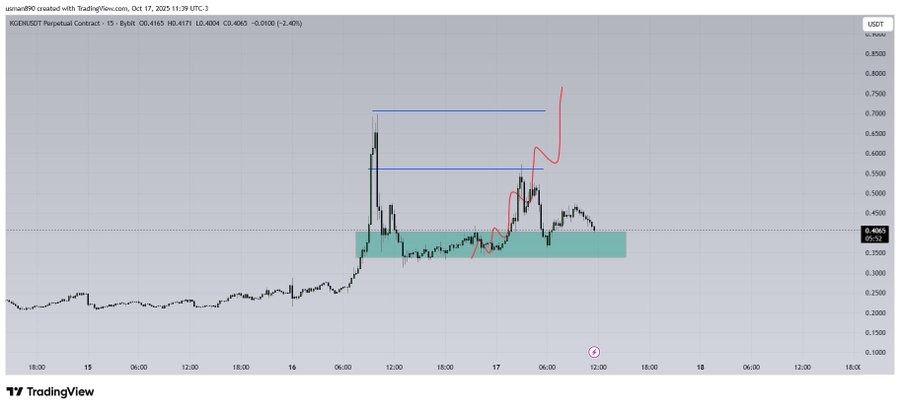

Stabilization of price KGEN: Buyers support major support levels

KGEN current trading activity indicates a well and healthy market that is consolidating. The price action has stabilised after initially being volatile following its listing where it reached a high of $0.6227. It is now trading solidly in the range of $0.26-0.27 which is serving as a robust technical floor.

This strength indicates that the buyers are engaged in the defence of the token at a reduced level. The second important milestone is to overcome the short-term opposition at the level of $0.29. Provided that purchasing volume continues this trend, the price is likely to shoot to the next significant goal of the $0.32-0.35 spectrum.

A strong, positive, progressive trend would be proven by successfully negotiating these price barriers. This stability of the news of prices is one of the main signs of the maturity of the market confidence.

A rigorous token release schedule guarantees long-term value

The ultimate objective in ensuring protection of the token value in the long term is achieved by KGEN, which is a mechanism of being conservative in supply. The project has a very rigid vesting timetable on the issuance of the tokens. Particularly, the core team and early strategic investors will have a large 12-month lock-up on tokens.

These tokens will not obtain the circulating supply immediately after this first lock, the cliff. Instead, the releases will be done progressively and in a linear fashion over the next 36 months. This planned, gradual step-by-step issue is very successful.

It keeps the number of sellable tokens that may burst the price at a sudden and overwhelming rate. Due to this, this managed timeline brings the financial inclination of all major stakeholders in line with the success of the project.

Known revenue and users indicate KGEN is an underpriced company

The business inherent that can be verified in the case of KGEN demonstrate that it is severely undervalued relative to its competitor, $COAI. KGEN is a profit-making company that has an Annualized Recurring Revenue (ARR) of 51.1 million. Moreover, this revenue is increasing at a very fast pace, about 6 months- on- months.

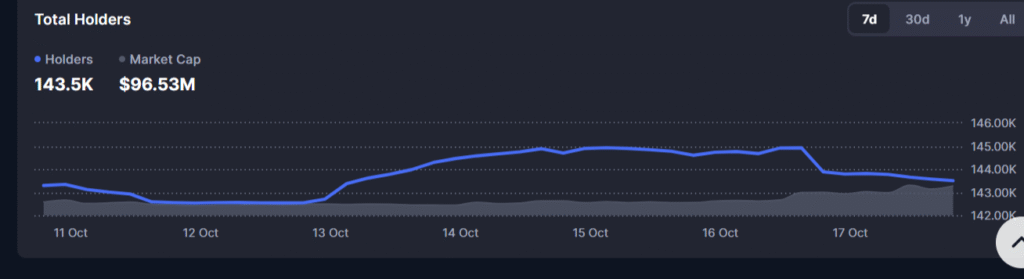

The company is optimistic in its self-projections which forecast that the ARR will be more than 60 million at the end of this year and eventually reach 100 million in 2026. At the same time, KGEN has created a huge, natural community: it has more than 41.9 million total users, 6.7 million of whom are active wallets. The network will ensure that this adoption is real by making sure that its users are 100% bot-free.

On the other extreme, though it is highly valued at $4 billion, $COAI is plagued with excessive centralization. Its supply is concentrated in the 10 top wallets to the alarming rate of 96%. Thus, its combination of quick and time-tested revenue growth and extensive, proven user adoption demands a much deeper and more fundamentally sound investment opportunity and makes KGEN underestimated.