The search of how to buy bitcoin is increasing. Why? Because.

The price Bitcoin (BTC) has skyrocketed in recent years. In May 2016, you could purchase 1 BTC for around $530. As of July 2025, 1 Bitcoin is above $100,000.

The original cryptocurrency’s highest intraday price in the previous year was $73,835.57 on March 14, 2024. That is a more than 7,900% increase. The current price of Bitcoin (BTC) is $108,000.

This spike demonstrates increasing trust and interest in the cryptocurrency industry, attracting investors from all walks of life. As Bitcoin continues to break down boundaries and reach new milestones, it highlights the changing environment of digital assets and the opportunity it provides for investors looking to buy Bitcoin.

Buying Bitcoin is sometimes the first step investors take into cryptocurrency, and right now, more investors may be seeking to take that step. Purchasing a more mainstream cryptocurrency, such as Bitcoin, can feel strange to those acclimated to traditional financial products.

The good news is that there are numerous ways to purchase Bitcoin and other cryptocurrencies, ranging from stockbrokers to specialist exchanges and even in-app transactions in some cryptocurrency-related applications.

In this article, Cryptoswami.com brings you a detailed step-by-step approach on how to buy Bitcoin, outlining the advantages and disadvantages of each method, including tips on choosing a reputable exchange and protecting your holdings.

Step-by-Step Guide on How to Buy Bitcoin (BTC).

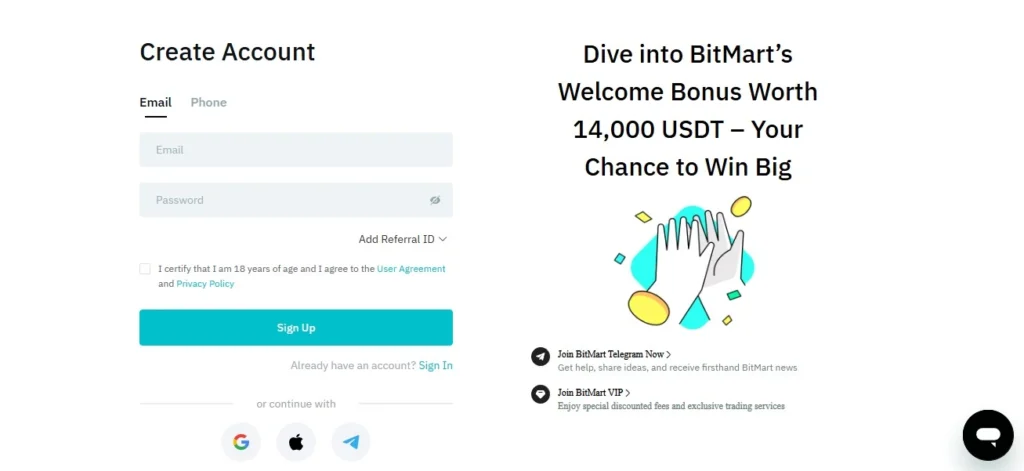

Creating an Account

Creating a trading account with a crypto exchange or broker is typically straightforward and takes only a few minutes.

To create an account, fill out the form with your information, including your complete name, email address, and password. Make sure you use a strong password with the correct characters.

You’ll need to confirm your email address to proceed.

Complete Identity Verification

After you validate your email, the KYC procedure begins. KYC stands for “Know Your Customer” and refers to how clients validate their identification before utilizing a financial service.

KYC is a legal obligation for financial institutions to avoid fraud, money laundering, and terrorism financing. Purchasing bitcoins necessitates confirmation of your entire name, date of birth, address, and a valid identity document.

Fund your Account

To purchase Bitcoin (BTC), you will require either fiat money or another cryptocurrency. So, before you can begin trading on an exchange, you must deposit a currency into your trading account.

The cryptocurrency exchange with which you have opened an account will offer a bank account and payment instructions when depositing fiat currency such as euros or dollars.

To deposit cryptocurrency, first create an address for the associated wallet. Some exchanges and brokers also allow you to buy cryptocurrencies with a credit card, PayPal, or other payment methods, simplifying and speeding up the transaction.

Place an Order

An order specifies how you purchase or sell a coin. Crypto exchanges have a variety of order kinds; below are some of the most common.

A market order is a request to purchase or sell a cryptocurrency at its current market price. A market order is executed immediately and is typically used to swiftly enter or exit a position.

A limit order is a request to purchase or sell cryptocurrencies at a specific price or higher. A limit order is handy for buying or selling at a lower cost.

Confirm your Order

After you place an order, it is essential that you confirm your order because several factors determine when and if your order will be completed.

A market order will be executed instantly if the crypto has sufficient liquidity. This implies that enough individuals must be willing to purchase or sell this coin.

A cryptocurrency like Bitcoin, exchanged several hundred thousand times daily, is highly liquid. In this case, the execution of the market orders is instant.

Secure your Account

Congratulations! You have officially purchased your Bitcoin! Next, you should start thinking about how to protect your cryptocurrency.

Due to the decentralized nature of cryptocurrencies, you are your bank, which means you are responsible for maintaining and preserving your crypto assets.

It would help if you did so via a cryptocurrency wallet to keep your Bitcoin safe. Wallets are classified into several varieties, each with its own set of pros and cons.

Choosing a Method to Buy Bitcoin (BTC).

Bitcoin wallets and crypto exchanges are two of the most popular ways to buy Bitcoin. However, you may buy Bitcoin through standard internet brokers and Bitcoin ATMs.

Here’s an overview of how to buy Bitcoin:

Bitcoin ATMs

Another alternative is to buy bitcoins straight from a Bitcoin ATM. A crypto ATM is a standalone electronic kiosk that allows people to purchase and sell cryptocurrencies for cash. There are over 35,000 Bitcoin ATMs globally.

The primary advantages are:

- Speed/Convenience. You can purchase and sell rapidly for small quantities without having to authenticate your identity. A Bitcoin ATM allows you to get cash in minutes. Other solutions often require 1-3 days to receive money in your bank account.

- Using Cash. Aside from face-to-face transactions, Bitcoin ATMs are the only means to purchase and sell Bitcoin with actual currency notes.

The main disadvantages are:

- Fee: Bitcoin ATMs typically have more significant fees than other methods. Fees range from 5 to 15% of the buy-or-sell price.

- Limits. Bitcoin ATMs often have lower transaction limits.

Crypto Wallet Software.

Some cryptocurrency applications, such as games, crypto wallets, and other online services based on blockchain technology, enable users to purchase and trade digital assets directly within the app.

Several platforms support bitcoin trading by providing a location for buyers and sellers to buy and sell orders and an escrow and dispute resolution service.

These platforms assist individuals in locating one another. Still, they are yet to be regarded as exchanges or money transmitters in many jurisdictions. Thus, you may not be required to divulge your identity to use them.

Most peer-to-peer Bitcoin exchanges have a reputation system that tracks and displays their members’ trade histories. Suppose you want to buy through a P2P exchange. You should pick sellers with a solid reputation, meaning they have completed multiple deals and never complained.

Tips for Selecting Reputable Crypto Exchanges.

Before you can begin trading or investing, you’ll need a platform for purchasing, selling, and storing digital assets: a cryptocurrency exchange.

Given the multiple options available, which cryptocurrency exchange is best for you and your needs? Here are some tips to consider:

Security Measure

Undoubtedly, the most crucial factor should be the security measures that an exchange provides. With noteworthy hacks in the past, an exchange’s resistance to potential attacks is critical. Look for platforms that use two-factor authentication (2FA), cold storage, encryption methods, and other advanced security features.

User Interface

Beginners want a simple and understandable user interface. Platforms that could be clearer or more complicated can turn off new users.

Fees and Charges

While most exchanges have straightforward cost systems, some may have hidden fees. Exchanges charge fees for various services, including deposits, withdrawals, and trading transactions.

Compare the fee structures of multiple exchanges to find the one that best suits your trading preferences and budget.

Regulation & Compliance

Ensure that the exchange adheres to the regulatory requirements in your jurisdiction. Compliance with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) gives users more trust and protection. Check whether the exchange has the necessary licenses or registrations with regulatory authorities.

Securing your Bitcoin (BTC) Holdings.

Even though the cryptocurrency sector has gained popularity, it has already developed an almost cliché-like narrative. A harmful hack on individual holdings or a digital currency exchange is rampant.

The hackers usually evaporate into the emptiness of online anonymity, carrying digital assets that are impossible to identify or retrieve.

Regarding Bitcoin security, a Bitcoin wallet is a must-have tool for each cryptocurrency user. A Bitcoin wallet is required because it is the only way to access and transact with Bitcoins.

There are a variety of Bitcoin wallets on the market, each with pros and cons. Security, usability, and device compatibility are critical before selecting a wallet.

Another way to protect your Bitcoin holdings is with 2FA (two-factor authentication). It’s a sophisticated security technique requiring two different forms of identity beyond simple passwords.

Your identity is authenticated more consistently due to the dual-layer security, which significantly strengthens protection against unwanted access.

Understanding Bitcoin (BTC) and its Value.

Bitcoin, invented in 2009 by an unidentified developer named Satoshi Nakamoto, is a decentralized digital currency transferred over a peer-to-peer network with no centralized authorities.

It is the world’s first decentralized cryptocurrency, with transactions secured and verified via blockchain technology. Bitcoin uses “proof-of-work” to record transactions transparently, prevent double spending, and assure consensus.

One of the primary factors fueling Bitcoin acceptance is its perception as a store of value. Unlike traditional fiat currencies, which are prone to inflation due to central bank policy, Bitcoin has a fixed supply limit of 21 million coins. This scarcity helps to preserve Bitcoin’s value and protect it from devaluation, as can occur with fiat currencies.

Institutional investment has also been critical in pushing Bitcoin acceptance to new heights. Bitcoin is increasingly recognized as an asset class worthy of investment by major enterprises, hedge funds, and asset managers. This shift in mentality has resulted in large money inflows to the Bitcoin market.

Conclusion

A convergence of factors, such as Bitcoin’s status as a store of value, institutional adoption, technological advancements, and global economic dynamics, have distinguished its development from a whitepaper to a global phenomenon.

While there are challenges, Bitcoin’s popularity is expanding, and its integration into the larger financial ecosystem is expected to progress further.

Your journey with digital assets starts with selecting the correct cryptocurrency exchange. You can locate an exchange that satisfies your requirements and preferences by considering security, regulation, liquidity, and user experience.

If this is your first time buying Bitcoin, the process may appear complex but easy. You only need a secure means to keep your purchases and an account at a service or exchange.