Cryptocurrency innovation is full of surprises, and one of the most underrated yet powerful concepts is wrapped tokens. Sounds fancy, right? But don’t worry, it’s actually pretty simple once you get the idea.

Let’s say you have Ethereum, but it’s on the Ethereum chain, and you want to use it on a DApp or DEX that runs on the BNB Chain. Or maybe you’ve got ETH, but not in the wallet that works with the Dapp you’re using. Either way, you’re stuck. That’s where wrapped tokens save the day.

Wrapped tokens are like clones of your original crypto but made to work on a different blockchain. They’re backed 1:1, so for every wrapped token, there’s the real thing locked up somewhere to match it. It’s like putting your crypto in a different outfit so it can fit in and play nicely on another chain.

If you’re just trading or new to crypto, you might not care much about wrapped tokens. But if you’re into DeFi, farming, or using DApps, it starts to matter a lot. Wrapped tokens let you move your assets across blockchains without needing to sell or swap everything.

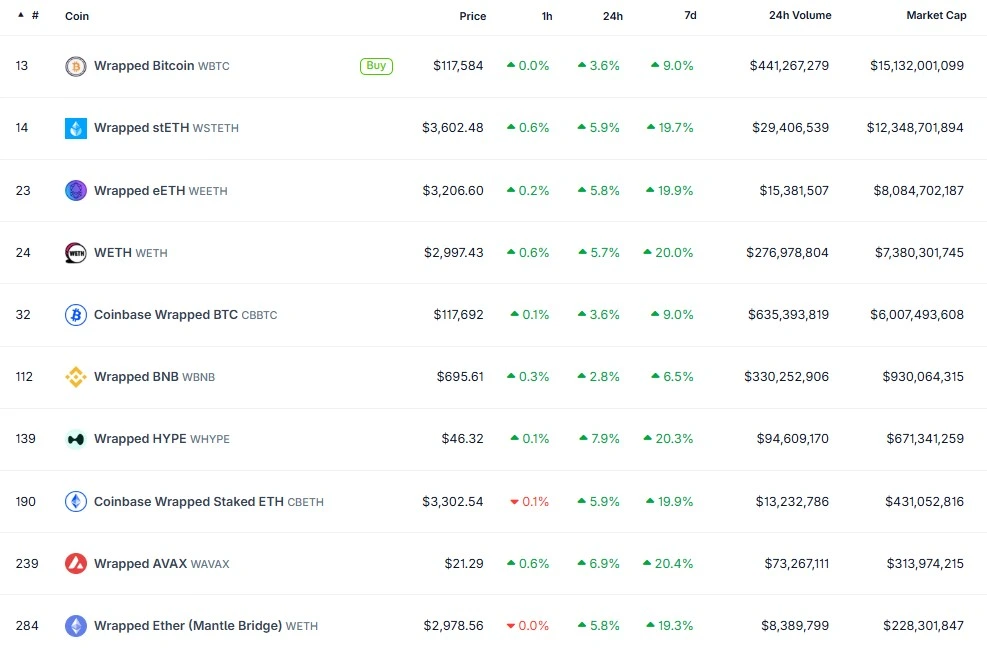

Some of the most popular wrapped tokens right now are:

- WBTC – Wrapped Bitcoin (lets you use BTC on Ethereum and other chains)

- WETH – Wrapped Ethereum (makes ETH easier to use in smart contracts)

- WBNB – Wrapped BNB (BNB in a form that works better with DApps)

There are over 50 wrapped tokens out there, and they’re a big part of making crypto more connected and flexible.

They help bridge ecosystems, enabling smooth interoperability between blockchains, and that’s a big deal in the decentralized world.

To make things clear, let’s break down what wrapped tokens are and how they work.

What is a Wrapped Token?

To make this easier to understand, imagine you’re in space and your spaceship gets hit by something. To fix the damage, you need to step outside, but you can’t just walk out into space without protection. You need a spacesuit. That suit lets you survive in a totally different environment. In a way, that spacesuit is like a wrapper.

Now let’s bring that back to crypto.

A wrapped token is kind of like a cryptocurrency wearing a spacesuit. It’s a tokenized version of another crypto asset, made to work on a different blockchain. It’s pegged 1:1 to the value of the original coin and can usually be unwrapped whenever you want to get the real thing (original crypto) back. Read More

These wrapped tokens are useful because the original assets (like BTC or ETH) might not work outside their own blockchain. Wrapping them gives them the flexibility to operate across chains, just like your spacesuit lets you walk outside your ship.

They derive their value from the original asset. WBTC is backed by BTC. WETH is backed by ETH.

But just to be clear, not everything backed by something is a wrapped token. For example, stablecoins like USDT or USDC get their value from fiat (like the US dollar), but they’re not wrapped tokens. They’re their own category.

Wrapped tokens help crypto be more flexible, more cross-chain, and more useful in DeFi.

How Do Wrapped Tokens Work?

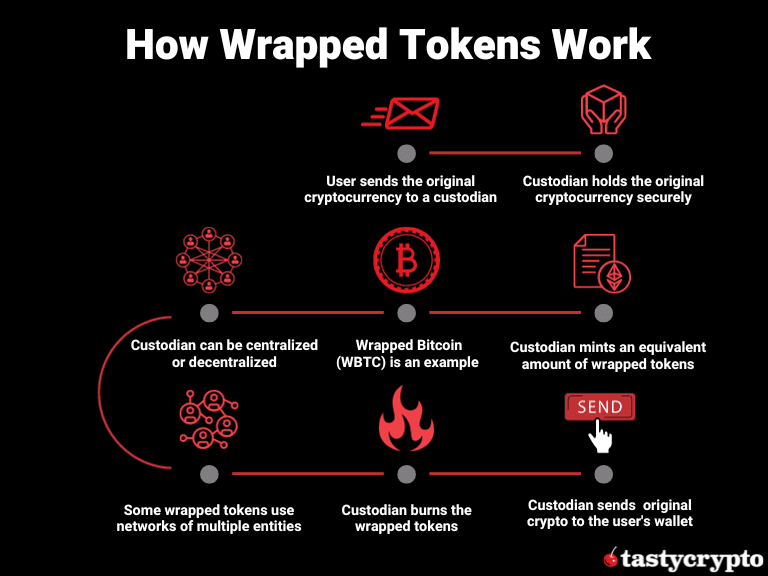

It’s not something you can do on your own. There are specific platforms called custodians that handle the working process. Think of them like trusted middlemen or service providers in the financial world.

Big DeFi projects like AAVE, 0x, and others act as custodians. When you want to convert your original cryptocurrency (like BTC) into a wrapped version (like WBTC), these custodians are the ones who mint the wrapped token on the target blockchain—such as Ethereum or BNB Chain.

Let’s take WBTC as an example:

- You give your BTC to the custodian.

- The custodian locks your BTC securely in reserve.

- Then, a DAO (Decentralized Autonomous Organization) mints the same amount of WBTC on Ethereum and sends it to your wallet.

This is a straightforward process.

Now, when you’re done using your WBTC and want to get your original BTC back:

- You convert WBTC back to BTC.

- The DAO burns (destroys) that amount of WBTC.

- The same amount of BTC is released back to you from the reserve.

So it’s always 1:1 backed and trust-based.

Wrapped tokens are always tied to the original coin. You can’t just create or transfer them freely between chains on your own. A custodian is always required to lock, mint, burn, and release the coins during this process. That’s why traders can’t simply use wrapped tokens independently for cross-chain moves; they need these trusted systems to handle the wrap and unwrap process properly.

What is the Purpose of the Wrapped Token?

The purpose of wrapped tokens is straightforward.

They let you use a native cryptocurrency on a different blockchain—mainly so you can access DApps and DeFi platforms that don’t support the original coin.

Wrapped tokens are a game-changer for Bitcoin holders. Normally, you can’t use BTC directly on Ethereum-based platforms. But with WBTC (Wrapped Bitcoin) or BTCB (on BNB Chain), you can interact with DeFi apps without needing to sell or swap your Bitcoin.

It is useful because.

- You keep your BTC exposure (price stays the same).

- You unlock access to things like lending, borrowing, staking, or farming on other blockchains.

- And when you’re done, you can always convert the wrapped token back to real BTC.

So basically, you don’t have Bitcoin in its original form—but you do have Bitcoin in a form that’s usable on another chain, and its value stays 1:1 with BTC.

How Do I Get a Wrapped Token?

Getting wrapped tokens is actually simple.

You can find them on many centralized exchanges (CEXs) like Binance, Coinbase, or Kraken. They often list popular wrapped pairs like WBTC/USDT, WETH/ETH, and others, just like regular coins.

But if you want to go a bit deeper into DeFi and explore more use cases, try using a decentralized exchange (DEX) like Uniswap, PancakeSwap, or 1inch. You just need.

- ETH in your wallet (like MetaMask) for ERC-20 tokens like WETH or WBTC.

- BNB in your wallet for BEP-20 tokens like BTCB on the BNB Chain.

These tokens let you access DeFi platforms where you can lend, borrow, stake, or farm to earn extra income without having to sell your original asset and while keeping the same price.

Some Popular Wrapped Tokens

Wrapped Bitcoin (WBTC): Wrapped Bitcoin delivers the power of Bitcoin with the flexibility of an ERC20 token. WBTC is the first ERC20 token backed by Bitcoin. Completely transparent. 100% verifiable.

Wrapped Ethereum (WETH): The Ethereum network’s native currency, Ether (ETH), was created way before the ERC-20 protocol that powers DeFi services. So, for ETH to be compatible with ERC-20, WETH was created.

Wrapped BNB (WBNB): It is a BEP-20 token built on the Binance Smart Chain.

Advantage of the Wrapped Token

Wrapped tokens like WBTC allow Bitcoin holders to use their BTC on decentralized applications (DApps), something the original Bitcoin blockchain can’t do because it doesn’t support smart contracts.

One major advantage is speed. Bitcoin’s network processes around 3–5 transactions per second, while Ethereum can handle 10–15, and Binance Smart Chain goes even faster with 55–60 transactions per second. So, using wrapped Bitcoin on Ethereum or BSC means transactions are much quicker compared to using native BTC.

Another benefit is the lower transaction fees. Transferring Bitcoin on its own network can be costly, especially during peak times. But using WBTC on BSC, for example, often costs less than $1 per transaction, making it a much more affordable option.

Overall, wrapped tokens help unlock the full potential of assets like Bitcoin by making them compatible with faster, cheaper, and more flexible blockchain environments.

Disadvantage of the Wrapped Token

While wrapped tokens offer flexibility and DeFi access, they do come with some important risks, especially when it comes to security and trust.

One of the biggest concerns is custody. When you wrap your Bitcoin, you’re not holding it anymore; a third party (like a custodian or organization) holds it for you. That introduces a level of centralization, which goes against the core idea of decentralization in crypto.

Unlike traditional cryptocurrencies that run on smart contracts, wrapped tokens don’t always follow a fully automated process. This means your BTC is basically locked until the custodian decides to release it. If something goes wrong or if the custodian is dishonest, you might not be able to get your Bitcoin back.

Even Ethereum co-founder Vitalik Buterin expressed concern, saying:

“I’m worried about the trust models of some of these tokens. It would be sad if there ends up being $5 billion of BTC on Ethereum and the keys are held by a single institution.”

Another issue is that the organizations managing wrapped tokens are often anonymous. Take WBTC, for example—it’s managed by a DAO (Decentralized Autonomous Organization). But if one person secretly controls the DAO and holds the wallet keys, it becomes a huge risk, especially if no one knows who that person really is.

Conclusion

Wrapped tokens might still be a growing concept, but there’s no denying that concept is a significant step forward in the crypto space. They open the door to doing more with your money, especially when it comes to DeFi and cross-chain utility.

If some of the current issues, like centralization and trust, get solved, wrapped tokens could truly be seen as “Bitcoin, but better” in certain use cases. And of course, WBTC isn’t the only wrapped token out there. There are plenty of others making waves across different blockchains.

If you’re holding a valuable wrapped token and using it smartly in DeFi, then you’re already one step ahead of those just sitting on their original coins.

So what do you think about wrapped tokens? Do you use any yourself?

And as always, do your own research (DYOR) before investing or jumping into any crypto.